Reduction in contributions due to a decrease in workplace accidents

CURRENTLY THE BONUS INCENTIVE REQUEST IS SUSPENDED

On December 24, 2022, the Law 31/2022, of December 23, on General State Budgets for the year 2023, which includes in its ninety-seventh additional provision the suspension of the system of reduction of contributions for professional contingencies due to a reduction in workplace accidents.

Specifically, the application of the system of reduction of contributions for professional contingencies is suspended for companies that have considerably reduced workplace accidents, provided for in the Royal Decree 231/2017, of March 10, for contributions generated during the year 2023 . This suspension will be extended until the Government proceeds to reform the aforementioned royal decree.

What does it consist of?

- Incentive system for the benefit of those companies that distinguish themselves for their contribution to the reduction of workplace accidents.

- Each company can submit an application for each CIF-CNAE.

- A change of CNAE will be treated as a different company.

What rule regulates it?

- Royal Decree 231/2017, of March 10.

- Order ESS/256/2018, of March 12.

- Order TMS/83/2019 , dated January 31.

What requirements must be met during the observation period to access the incentive?

1. Having contributed more than 5,000 euros to Social Security for professional contingencies during the observation period for which the request is made or having reached a contribution volume of 250 euros in an observation period of four consecutive years.

2. Not reaching the limits of the general and extreme accident rates.

3. Be up to date with compliance with your Social Security contribution obligations as of the end date of the application submission period (this requirement will be verified by the TGSS on May 31 of the year of submission of the application, so the company is recommended to request a certificate accrediting current payment for that date).

4. Not having been sanctioned by a final administrative resolution for very serious infractions or more than two serious ones, in matters of occupational risk prevention or Social Security.

5. Comply with the obligations regarding occupational risk prevention described in the regulations.

6. Have informed the prevention delegates of the incentive request, and of the accident rates when the company is aware.

What is the observation period?

- It is the number of consecutive calendar years immediately preceding the submission of the application, necessary to reach the minimum contribution volume (exceeding 5,000 euros in the observation period or having reached 250 euros in an observation period of four years) and that have not been part of a previous application with a maximum of four years .

- To determine the observation periods for the years 2017, 2018 and 2019, the previous definition is applied, as long as said exercises have not formed part of an application in accordance with the previous regulations.

You can check your quote for professional contingency for the application of the incentive in our Digital Office of Fraternidad- Muprespa from the Menu section.

What are general and extreme accident rates?

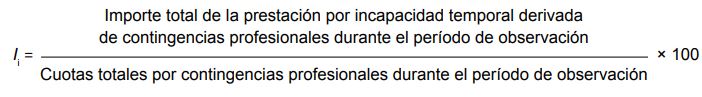

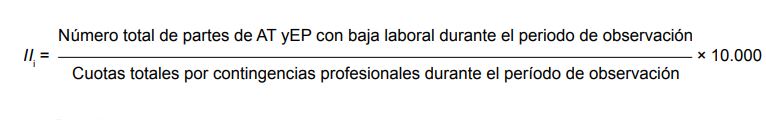

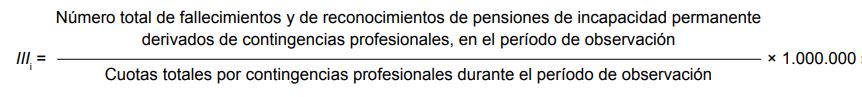

- The general (Ii,IIi) and extreme (IIIi) accident rates formulated in Annex II of RD 231/2017 are:

- In itinere type accidents are excluded from the calculation of the general and extreme accident rates.

- The limit thresholds by CNAE for 2019 are established in the annex to the Quotations Order Order TMS/83/2019, of January 31.

You can check the value of each of your indices for the application of the incentive in our Digital Office of Fraternidad-Muprespa from the Menu section.

What is the deadline to submit my application?

- From April 15 to May 31 of each year.

Where should I submit my application?

- Companies associated with

If you have any questions, contact us through our Web Service Desk or contact your nearest Fraternidad-Muprespa center (by phone or in person).

How much can I receive?

- The incentive may reach 5% of the professional contingency fees.

- Another additional 5% will be recognized in the event that there is investment by the company in any of the complementary actions for the prevention of occupational risks included in sections 6 or 7 (in the case of small companies) of Annex I of the RD 231/2017 of March 10.

- A small company is considered to be any company that has a volume of professional contributions greater than or equal to 250 euros and less than or equal to 5,000 euros, in an observation period of 4 years.

Procedure to process the application

- The information regarding your company's contributions in the observation period in which it has been associated with .

- Those companies that have been associated with different mutual societies collaborating with Social Security during the observation period must complete the information related to contributions and accidents using the following certificate model .

- If you already have a user to access our extranet services, simply enter your username and password and access the Menu/Bonus/Bonus Request option.

Request now to register as a user and start enjoying all the services we offer to our mutual ualists and collaborators. To formalize the registration, it will be necessary to sign a contract of conditions of use of the Digital Office.

What documents do I need to formalize the request?

- Responsible declaration.

- Copy of D.N.I., N.I.E., passport or driver's license of the representative.

- Copy of the powers of attorney.

- Certificate of bank ownership.

- Certificate from other mutual insurance companies when applicable.

If you have any questions, contact your nearest

Incentive payment

- The payment of the incentive will correspond to the mutual insurance company to which the company was associated at the time of the application.