Main Data 2004

Collection

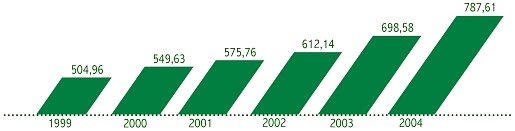

The total fees accrued in fiscal year 2004 amounted to €787,607,360.12, which represents an increase over the previous year of 12.74 percent. Of the total contributions, €553,886,793.48 correspond to Professional Contingencies and €233,720,566.64 to Common Contingencies, with an increase over the previous year of 9.43% and 21.47%, respectively.

Evolution of accrued fees (millions of euros)

| CHARGED (€) | % Increase | ACCRUED (€) | % Increment | ||

| Professional Cont. | 543,632,826.01 | 10.09 | 553,886,793.48 | 9.43 | |

| Common cont. | 230,217,865.94 | 21.67 | 233,720,566.64 | 21.47 | |

| TOTAL | 773,850,691.95 | 13.30 | 787,607,360.12 | 12.74 |

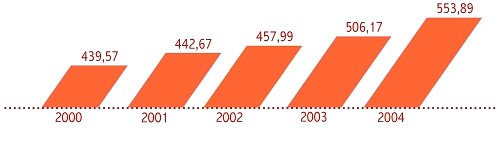

Professional Contingencies

Of the total contributions accrued in Professional Contingencies (€533,886,793.48), €521,535,169.86 correspond to the General Regime, €20,992,736.31 to employed workers of the Special Agrarian Regime, €6,617,616.64 to the Special Regime of the Sea, €1,014,593.39 to the Special Coal Mining Regime, €1,069,327.09 to the R.E.A. Own Account and 2,657,350.19 to the Self-Employed.

Evolution of accrued fees for professional contingencies (millions of euros)

Of the total contributions accrued in Professional Contingencies, €286,329,579.02 correspond to the coverage of the risk of Temporary Disability and €267,557,214.46 to Disability, Death and Survival, which represents 51.69%. and 48.31% respectively, on the total of these quotas.

In fiscal year 2004, the largest percentage increase in Professional Contingency quotas, compared to the previous year, was in the Sea Regime with 48.91%, followed by the General Regime with 9.68%.

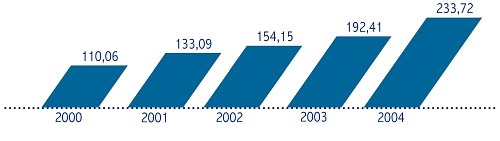

Common Contingencies

Of the total contributions accrued in Fiscal Year 2004 related to the economic benefit of Temporary Disability for Common Contingencies (€233,720,566.64), €196,404,751.64 correspond to self-employed workers of the General and Assimilated Regime, €35,069,456.16 to self-employed workers and €2,246,358.84 to self-employed workers of the Special Agrarian Regime.

Evolution of accrued fees for common contingencies (millions of euros)

Of the total quotas corresponding to Common Contingencies, 84.26% correspond to employed workers and the remaining 15.74% to self-employed or self-employed workers.

The largest percentage increase in quotas that occurred in 2004 compared to the previous year was that of the Self-Employed workers with 92.18%, followed by the R.E.A. with 79.21% and the General Regime with 14.12%.