Rates and Quotes

With the entry into force on January 1, 2023 of Royal Decree-Law 13/2022 of July 26, 2022, a new S contribution system is established for self-employed workers and the protection for cessation of activity is improved, where the main novelty is the contribution based on the returns obtained, except religious institutions belonging to the Catholic Church.

The calculation of the net income will be carried out on the total of the different activities carried out as a self-employed worker, to which you will have to add the amount of the contributions paid to Social Security if you are taxed according to the direct estimation regime.

This calculation will be carried out as provided in the regulations on Personal Income Tax, and with some specialties depending on whether you belong to groups such as commercial partners.

To these returns, a deduction for generic expenses of 7% will be applied, a percentage that, in the case of commercial partners or labor partners, who have been registered as self-employed for 90 days in the year, the deduction is reduced to 3%.

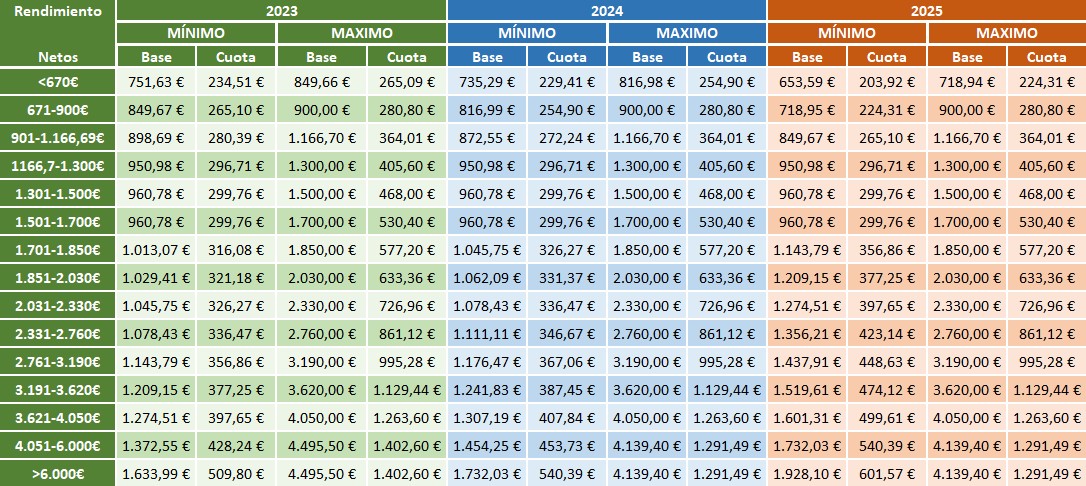

Once the monthly average of your annual returns has been calculated, you can choose the contribution base within the section based on the average monthly amount of the return, where in the event that the forecast places the amount below €1,166.70/month, you can opt for a lower contribution base and included in the first three rows of the table quote .

The contribution base that would have been chosen will be provisional and will be unique for all situations protected by the Social Security system, where the corresponding self-employed quota is calculated by applying a contribution rate of 31.20% to the chosen contribution base between the minimum and maximum base within each section.