You can make your tax return more supportive

Between April 1 and June 30, the deadline to submit the income tax return is in force, a procedure that remains in force despite the declaration of the state of alarm and how it affects many administrative procedures.

Fraternidad-Muprespa signed a collaboration agreement with the Social Action NGO Platform in 2019. It is a state-level organization that brings together 33 non-governmental entities that work in favor of vulnerable groups and in the fight against social exclusion. Since 2002, they have been promoting this campaign called “X Solidaria”, which allocates the money raised to help thousands of people in vulnerable situations.

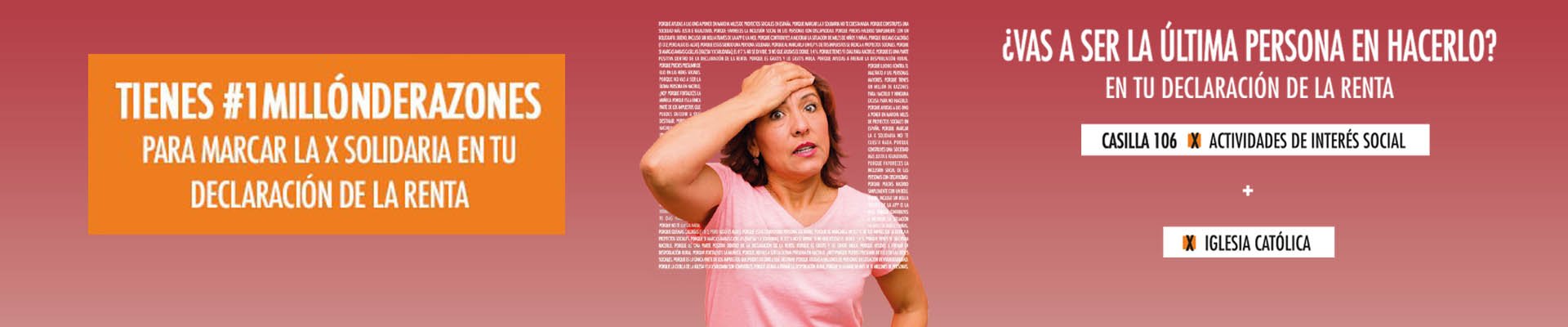

As taxpayers know, a part of the taxes can be allocated to activities of Social Interest, to the Church or to both purposes, if both boxes are checked. Choosing one, the other or both does not mean paying more or getting a lower return.

“There are those who think that if both boxes are checked, 0.7% of the income tax is distributed between both, but this is not the case: if both boxes are checked, 0.7% is allocated to each of the causes, doubling the amount allocated to social causes. It is important that people who exclusively check the Church box know that if they also checked the Social Interest Activities box they would be favoring the development of projects NGOs linked to the Catholic Church that also manage projects within the framework of the call for grants, and vice versa,” says Asunción Montero, President of the Platform.

For her part Natalia Fdez. This is what moves Fraternidad-Muprespa to join this initiative, which does not subtract and add for the most disadvantaged.”