Extraordinary cessation of activity benefits for self-employed workers regulated in Royal Decree-Law 2/2022 (7th package)

El 29 de septiembre se ha publicado el Real Decreto-ley 18/2021, sobre medidas urgentes para la protección del empleo, la recuperación económica y la mejora del mercado de trabajo. Este RD-ley, entre las medidas de apoyo para el colectivo de los trabajadores autónomos que desarrolla, establece 6 nuevas prestaciones.

En el siguiente cuadro se muestra un resumen de las mismas:

Tipos de prestaciones y legislación

|

RULES |

BENEFIT |

APPLICATION DEADLINE |

MAXIMUM DURATION |

|---|---|---|---|

|

Art. 8 |

Exemption from contributions for self-employed workers who on September 30 were receiving any of the benefits regulated in arts. 7 and 8 RDL 11/2021, of May 27. |

Managed by the TGSS |

January 2022 |

|

Art. 9 |

Benefit for self-employed workers affected by a temporary suspension of activity as a result of a resolution by the competent authority. |

From: the day on which the resolution to suspend the activity is published. Until: 03/20/2022 |

According to the period of validity of the suspension. Maximum: February 28, 2022. |

|

Art. 10 |

Benefit compatible with self-employment for self-employed workers with sufficient contributions upon cessation of activity. |

Since: 01/10/2021(*) Until: 01/31/2022 |

02/28/ 2022 |

|

Art. 11 |

Extraordinary cessation of activity benefit for self-employed workers who do not have a need to access either the ordinary cessation of activity benefit, or a cessation benefit compatible with self-employment. |

Since: 01/10/2021(*) Until: 01/31/2022 |

02/28/2022 |

|

Art. 12 |

Extraordinary cessation of activity benefit for seasonal workers from June to December. |

Since: 01/10/2021(*) Until: 01/31/2022 |

02/28/2022 |

|

DA 6th |

Extraordinary Social Security measures for self-employed workers affected by the volcanic eruption registered in the Cumbre Vieja area in La Palma. |

Since: 10/01/2021(*) Until: 01/31/2022 |

02/28/2022 |

(*) Para devengar la prestación desde el 1 de octubre de 2021, deberá presentarse la solicitud entre el 1 y 21 de octubre (ambos inclusive).

A continuación, se resumen los principales cambios y puntos de interés del RD-Ley 18/2021, respecto a sus antecesoras:

Exención en la cotización a favor de los trabajadores autónomos que a 30 de septiembre de 2021 vinieran percibiendo alguna de las prestaciones reguladas en los art. 7 y 8 del Real Decreto-Ley 18/2021, de 27 de mayo, sobre medidas urgentes para la defensa del empleo, la reactivación económica y la protección de los trabajadores autónomos (Art. 8. RD-Ley 18/2021):

Se establece la exención de cuotas a los trabajadores autónomos que vinieran percibiendo las prestaciones reguladas en los arts. 7 y 8 del RD-ley 11/2021 hasta el 30/09/2021 en las siguientes cuantías:

- Exención del 90 % de las cotizaciones correspondientes a octubre de 2021.

- Exención del 75 % de las cotizaciones correspondientes a noviembre de 2021.

- Exención del 50 % de las cotizaciones correspondientes a diciembre de 2021.

- Exención del 25 % de las cotizaciones correspondientes a enero de 2022.

Deberá mantenerse la situación de alta hasta el 30/01/2022.

La base se determinará en función de la que percibiera hasta el momento del acceso a la prestación anterior.

Estas exenciones son incompatibles con la percepción de cualquiera de las nuevas prestaciones extraordinarias de cese de actividad (reguladas en los arts. 9 a 12 del RDL 18/2021 ni en la prevista en la disposición adicional sexta de este mismo RD-Ley).

En caso de percibir la prestación regulada en el art. 9 del presente RD-Ley (suspensión de la actividad), la exención volverá a será aplicable desde el momento en que el trabajador se vea obligado a tener que volver a cotizar.

La exención de la cotización NO SE GESTIONA POR LA MUTUA, se gestiona directamente por la Tesorería General de la Seguridad Social (TGSS). Cualquier duda sobre esta ayuda deberá remitirla a la TGSS.

Prestación extraordinaria de cese de actividad para trabajadores autónomos afectados por la suspensión temporal de toda la actividad como consecuencia de resolución de la autoridad competente como medida de contención de la propagación del virus COVID-19 (Art. 9. RD-Ley 18/2021):

Esta prestación está destinada a los trabajadores autónomos que se vean obligados a suspender todas sus actividades, como consecuencia de una resolución adoptada por la autoridad competente como medida de contención en la propagación de la COVID-19.

Podrán acceder a esta prestación tanto aquellos que vean suspendida su actividad a partir del 1 de octubre de 2021, como aquellos que la tuvieran suspendida previamente y no la hubieran solicitado antes del 1 de octubre de 2021.

Comentario: si el 30 de septiembre de 2021 se viniera percibiendo la prestación del art.6 del RD-Ley 11/2021, por seguir suspendida la actividad, será necesario solicitar esta nueva prestación (no se prórroga automáticamente).

Los efectos y fechas de solicitud de esta prestación dependerán de la fecha en que entre en vigor la resolución de suspensión de la actividad:

1. Resolución de suspensión de actividad previa a 1 de octubre:

- Si se presenta entre el 1 y el 20 de octubre (incluido): se devengará la prestación desde el 1 de octubre.

- Si se presenta a partir del 21 de octubre (incluido): se devengará la prestación a partir del 1 de mes siguiente a recibirse la solicitud.

2. Resolución de suspensión de actividad a partir de 1 de octubre:

- Si se presenta en los 21 días naturales siguientes a la publicación de la resolución de suspensión: se devengará la prestación desde el día siguiente a la fecha en que se declara la suspensión.

- Si se presenta superado el plazo anterior: se devengará la prestación a partir del 1 de mes siguiente a recibirse la solicitud.

En el resto de cuestiones es muy similar a la prestación extraordinaria de suspensión de la actividad regulada en el art. 6 del RD-ley 11/2021.

Prestación por cese de actividad compatible con el trabajo por cuenta propia (Art. 10. RD-ley 18/2021):

Esta prestación está dirigida a aquellos trabajadores autónomos que prevén que durante los próximos meses no van a recuperar los niveles de actividad previos a la situación de crisis originada por la pandemia y que tengan un mínimo de cotizaciones por la contingencia de cese de actividad.

La mayor parte de los requisitos y condiciones son similares a los establecidos en la prestación regulada en el art. 7 del RD-ley 11/2021. Las principales novedades son:

- La fecha para presentar las solicitudes en plazo finaliza el 21 de octubre (inclusive) y éstas tomarán efectos desde el día 1 de octubre, el resto tendrán efecto a partir del día 1 del mes siguiente a haber sido solicitadas.

- La prestación tendrá una duración máxima de 5 meses, como máximo, hasta el 28 de febrero de 2022 (la anterior era como máximo 4 meses).

- El requisito económico se establece en el periodo comprendido entre el 3er y 4º trimestre de 2021 requiriéndose una reducción de los ingresos computables fiscalmente de la actividad por cuenta propia, de más del 50% respecto al mismo periodo del ejercicio 2019.

- Prever no obtener durante el 3er y 4º trimestre de 2021 unos rendimientos netos computables fiscalmente superiores a 8.070 € (antes eran 7.980 €).

- En el caso de trabajadores que tributen por estimación objetiva, la reducción de los ingresos también podrá darse por acreditada en función de la reducción del promedio de trabajadores afiliados al CNAE de cada actividad, comparando el 3er y 4º trimestres de 2021 con el mismo periodo de 2019.

Prestación extraordinaria de cese de actividad para aquellos trabajadores autónomos que ejercen actividad y a 30 de septiembre de 2021 vinieran percibiendo alguna de las prestaciones de cese de actividad previstas en los artículos 7 y 8 del Real Decreto-ley 11/2021, de 27 de mayo, sobre medidas urgentes para la defensa del empleo, la reactivación económica y la protección de los trabajadores autónomos y no puedan causar derecho a la prestación ordinaria de cese de actividad prevista en el artículo 10 de este real decreto-ley (Art. 11. RD-ley 18/2021)

Esta prestación está orientada a aquellos trabajadores autónomos que, a 30 de septiembre de 2021, vinieran percibiendo alguna de las prestaciones reguladas en los Arts. 7 y 8 del RDL 11/2021 y no puedan ser beneficiarios de la regulada en el Art. 10 del RD-ley 18/2021 ni de la prestación de cese de actividad ordinaria regulada en el título V del TRLGSS.

La mayor parte de los requisitos y condiciones son similares a los establecidos en la prestación regulada en el art. 8 del RD-ley 11/2021. Las principales novedades son:

- La fecha para presentar las solicitudes en plazo finaliza el 21 de octubre (inclusive) y éstas tomarán efectos desde el día 1 de octubre, el resto tendrán efecto a partir del día 1 del mes siguiente a haber sido solicitadas.

- La prestación tendrá una duración máxima de 5 meses, como máximo, hasta el 28 de febrero de 2022 (la anterior era como máximo 4 meses).

- El requisito económico se establece con el 4º trimestre de 2021 requiriéndose una reducción de los ingresos computables fiscalmente de la actividad por cuenta propia, de más del 75% respecto al mismo periodo del ejercicio 2019.

- Prever no obtener durante el 3er y 4º trimestre de 2021 unos rendimientos netos computables fiscalmente superiores al 75% del SMI (antes eran 6.650 €).

- En el caso de trabajadores que tributen por estimación objetiva, la reducción de los ingresos también podrá darse por acreditada en función de la reducción del promedio de trabajadores afiliados al CNAE de cada actividad, comparando el 4º trimestre de 2021 con el mismo periodo de 2019.

- Tengan como único trabajo a lo largo de los años 2018 y 2019 el que hubieran realizado en el Régimen Especial de Trabajadores Autónomos o en el Régimen Especial de Trabajadores del Mar, durante un mínimo de cuatro meses y un máximo de siete en cada uno de los años. Y que, además, al menos 2 de esos meses deben haber estado entre los meses de octubre y diciembre de cada año.

- No hayan estado en alta, o asimilado al alta, como trabajador por cuenta ajena en el régimen de la Seguridad Social correspondiente, más de 60 días durante el 2º y 3er trimestre de 2021.

- No prever obtener, durante el 3er y 4º trimestre de 2021, unos ingresos netos computables fiscalmente, que superen los 6.725 € (anteriormente eran 6.650 €).

- La duración máxima de la prestación podrá ser de 5 meses, como máximo, hasta el 28 de febrero de 2022 (la anterior prestación como máximo eran 4 meses)

Comentario: En la referencia al SMI debe tenerse en cuenta que por aplicación de lo dispuesto en el art. 1 del Real Decreto 817/2021, de 28 de septiembre, por el que se fija el salario mínimo interprofesional para 2021; con efectos del 1 de septiembre de 2021, el SMI diario ha pasado de 950 € (aplicable a julio y agosto) a 965 €/mes (aplicable a septiembre, octubre, noviembre y diciembre).

Prestación extraordinaria de cese de actividad para los trabajadores de temporada (Art. 12. RD-Ley 18/2021):

Para esta prestación se consideran trabajadores autónomos de temporada, aquellos que...

No se excluirán de esta condición aquellos que también hayan trabajado por cuenta ajena en los años 2018 y 2019, siempre que el alta como trabajador por cuenta ajena no supere los 120 días a lo largo de estos dos años.

La mayor parte de los requisitos y condiciones son similares a los establecidos en la prestación regulada en el art. 9 del RD-ley 2/2021, con las siguientes salvedades:

La prestación solicitada hasta el 21 de octubre (inclusive), tomará efectos del 1 de octubre, mientras que las presentadas fuera del citado plazo devengarán la prestación a partir del día 1 del mes siguiente a la solicitud.

Medidas extraordinarias de Seguridad Social para los trabajadores autónomos afectados por la erupción volcánica registrada en la zona de Cumbre Vieja en La Palma. (Disposición adicional sexta del RD-Ley 18/2021):

Esta prestación está orientada a aquellos trabajadores autónomos que, como consecuencia directa de la erupción volcánica registrada en la zona de Cumbre Vieja en La Palma, se ven obligados a suspender o cesar en su actividad profesional.

En realidad, estamos ante un mecanismo de acceso a la prestación de cese de actividad ordinario regulado en el título V del TRLGSS por motivo de fuerza mayor que permite reconocer una prestación de 5 meses a los trabajadores que no tendrían carencia y que amplían en 5 meses la prestación a aquellos que si la tuvieran.

Siendo una solicitud de cese de actividad ordinario por fuerza mayor, como consecuencia de la erupción volcánica registrada en la zona de Cumbre Vieja el pasado 19 de septiembre de 2021, el plazo para presentar las solicitudes sin que se apliquen penalizaciones terminaría el 31 de octubre de 2021.

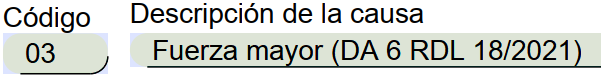

La solicitud de esta prestación deberá realizarse a través del formulario de prestación de cese de actividad ordinario informando como motivo del cese lo siguiente:

Dicha solicitud debe acompañarse de su correspondiente declaración jurada (sin necesidad de ninguno de los anexos).

Puede remitir su solicitud telemáticamente al correo electrónico de su delegación de Fraternidad-Muprespa más cercana a usted. Ver listado de direcciones electrónicas AQUÍ