Review of extraordinary benefits for cessation of activity regulated in art. 13.1 of Royal Decree-Law 30/2020, of September 29

In relation to the review of CATA.COVID-19 benefits (it is recommended to read previously), in August 2024 the review campaign of the extraordinary cessation of activity benefit for self-employed workers that was regulated in art. 13.1 of Royal Decree-Law 30/2020, of September 29, on social measures to reactivate employment and protect self-employed work and competitiveness of the industrial sector (hereinafter, PECANE 1.1).

This new extraordinary benefit (PECANE 1.1) had the purpose of supporting the self-employed who were forced to suspend all their activities as a result of a resolution adopted by the competent authority as a measure to contain the spread of the COVID-19 virus.

Fraternidad-Muprespa recognized nearly 9,600 of these benefits, for an approximate amount of 6.5 million euros.

In accordance with the provisions of letter i) of article 13.1 of Royal Decree-Law 30/2020, the recognition of said benefits was provisional and its definitive recognition was subject to a subsequent review.

In this review process of the provisionally recognized PECANE 1.1, various incidents or lack of information may have been detected that have prevented the mutual insurance company from elevating the provisional recognition of the benefit to definitive status.

The main doubts and incidents that may arise in this review process of PECANE 1.1 are clarified below and the possible allegations and/or documentation that you can provide to clarify or correct the incidents reflected in the hearing process that you may receive are indicated.

FREQUENTLY ASKED QUESTIONS

1. Questions related to the processing of allegations

Any means of notification will be admitted to present the allegations that it deems appropriate. However, at They will provide an immediate acknowledgment of receipt and the possibility of monitoring the processing status online. Furthermore, allegations received by this means will be resolved on a preferential basis.

However, you can also send us your allegations by any other means (recommending that it be a means that reliably certifies delivery).

Consult the address of your nearest management center: Fraternidad.com/centros .

If you are the self-employed worker's advisor and have a digital office user, we recommend that you complete the allegations process by accessing the following link:

Fraternidad.com/oficinadigital

In any other case, if you do not yet have a Digital Office user, you can process allegations through the following address:

to our Digital Office, you can send us your allegations by following the steps described in this manual .

2. Questions related to access to the benefit

During the review, the following points will be analyzed:

a) Be registered in the Special Social Security Regime, at least 30 calendar days before the date of the resolution that agrees to cease activity.

b) Be up to date with the contributions with Social Security on the date of suspension of the activity or have a deferral recognized prior to said date.

It should begin by clarifying that affiliation to Social Security is the responsibility of the General Treasury of Social Security (TGSS) and that the Mutual Fund can only access to verify the information, but cannot modify it.

Within the verification acts in the review of this benefit, the Mutual Fund has agreed to verify the affiliation status that, today, appears in TGSS and, either it has not been possible to verify that it was registered in the Special Regime, or it has been verified that it was not registered. in the Special Regime at least 30 calendar days from the date of the resolution agreeing to the cessation of the activity.

Please note that, due to the time elapsed, it could be that since you requested the benefit there has been some modification in your affiliation that affected the provisional recognition that was made to you.

In these cases you must request from the TGSS a certificate indicating the date of registration in the Spatial Regime that was at least 30 calendar days prior to the date of the resolution agreeing to the cessation of the activity.

You must provide us with said certificate, along with the copy or exact reference to the resolution of the competent authority that agreed to the mandatory cessation of your activity. In any case, you can always provide any legally accepted documentation that you consider can prove the requirement for registration in the Special Regime.

First of all, we must indicate that the debt information has been obtained from the databases of the General Treasury of Social Security (TGSS) and that the Mutual Fund only has consultation access to said data, and cannot clarify or modify said information.

To prove the non-existence of the debt, there are the following alternatives:

- Provide a certificate from the TGSS that certifies that on the date of suspension of your activity you were up to date with all debts with Social Security.

- Provide a resolution from the TGSS to defer the debt that may have been recognized prior to the date of suspension of your activity and accompany said resolution with documentation that proves that you have complied, throughout the receipt of this CATA.COVID-19 benefit, with the amortization periods indicated in the aforementioned resolution.

- If during the receipt of the benefit you received an invitation to pay the fees owed, you may provide documentation that justifies that you were up to date with said fees within 30 days of receipt.

Otherwise, this invitation will have been made to you along with the hearing process and, therefore, you will have 30 calendar days to pay all the debt you owed to Social Security (prior to the date of suspension of your activity). If you pay said debt, you must provide proof of payment of the debt and a certificate from the TGSS that you are up to date with payment on the date of suspension of your activity.

Important: In order to catch up on payment of the debt prior to the date of suspension of your activity, the recognition of a debt deferral after said date will have no effect (only the effective payment of the debt will have that effect).

Along with the previous documentation, you must always provide a copy or exact reference to the resolution of the competent authority that agreed to the mandatory cessation of your activity, which allows you to verify the date on which you were forced to suspend your activity.

In any case, you can always provide any legally accepted documentation that you consider can prove that you were up to date with your Social Security contributions on the date of suspension of your activity.

This may be because the Mutual Fund, with the information at its disposal, has not been able to find the resolution of the competent authority that would force it to suspend its activity on the date on which the benefit was provisionally recognized.

This incident may be due to several reasons:

- Related to self-employed activity:

- The activity that he carried out on his own account was not required to be suspended by any resolution of a competent authority.

- The activity that the mutual insurance company has considered does not correspond to the activity that it carried out on its own account at that time.

- Related to the place where you carried out your professional activity:

- The town in which who carried out his professional activity was not affected by the resolution of the competent authority that required him to suspend his activity.

- The location that the mutual company has considered does not correspond to the one in which it actually carried out the activity on its own account.

- On the date on which the benefit was recognized, the suspension of the activity had not yet been declared by the competent authority or said restriction had already ended.

In order to verify compliance with this requirement you must provide the following documentation:

- Census of business activities for 2020 and 2021.

- Copy or exact reference to the resolution of the competent authority that agreed to the mandatory cessation of your activity (on the date on which the benefit was recognized).

In any case, you can always provide any legally accepted documentation that you consider can prove that you were forced to suspend your activity by resolution of the competent authority.

The recognition of this CATA.COVID-19 benefit implies that you cannot carry out any type of activity on your own, which is why if a self-employed person is registered in more than one economic activity, it must be proven that all of them were suspended by resolution of the competent authority.

Likewise, the maintenance of the benefit is subject to the fact that during its receipt no new self-employed activity is started.

Since the mutual insurance company does not have access to this information, information is required to prove the activities in which you were registered and that you did not carry out any activity after the benefit accrued. For these purposes, you must provide us with the Census of business activities for 2020 and 2021.

If any activity that you did not carry out appears in said census , you may provide any evidence admitted by law that proves that you did not really carry out said activity despite it being listed in the census of business activities provided.

3. Questions related to the amount of the benefit received

There are several reasons that may result in a higher benefit being paid than what should have been due. Among them, the most common are the following:

- Overlapping with other Social Security benefits: this CATA.COVID-19 benefit is not compatible with the receipt of other Social Security benefits that, in turn, are not compatible with the development of self-employed activity. If during the receipt of this CATA.COVID-19 benefit you also benefited from other Social Security benefits (temporary disability, birth and care of a minor - former maternity/paternity -, risk during pregnancy or breastfeeding, permanent disability, retirement,...) the days in which both benefits coincided simultaneously will be deducted and claimed from this CATA.COVID-19 benefit.

- Incompatibility with work performed as an employee and/or unemployment: this CATA.COVID-19 benefit is incompatible with the performance of work as an employee or with the receipt of unemployment benefit, when the net income from work as an employee exceeds 1.25 times the amount of the minimum interprofessional wage.

If the above limit is not exceeded, the receipt of the CATA.COVID-19 benefit would be compatible with the situation of pluriactivity.

- Incompatibility of the income received from the company affected by the closure: this CATA.COVID-19 benefit is incompatible with the income that may have been received from any of the companies in which it participates or manages and that has been affected by the closure.

- Incompatibility with the exercise of another self-employed activity: this CATA.COVID-19 benefit is incompatible with the exercise of any other self-employed activity.

- Differences in the regulatory base: due to the difficulties in accessing information in the first period of the pandemic, CATA.COVID-19 benefits could be recognized with a higher regulatory base than what would have actually corresponded. If this difference had been detected during the review, the benefit would have been recalculated in accordance with the correct regulatory basis and any differences that may exist would have been claimed.

- Differences in the daily amount paid: this may be due to having incorrectly applied the percentages that the rule established based on the situation of the family unit.

Depending on the situation of the family or cohabitation unit, the amount of the benefit could be:

- A 40% of the regulatory base, when people united by family ties or similar cohabitation units live together in the same home up to the first degree of kinship by consanguinity or affinity, and more than one member entitled to this same benefit. .

- A 70% of the regulatory base, in those family units that accredit the status of large family , whose only income came from the suspended self-employment activity and in which there was only a single beneficiary of this benefit .

- A 50% of the regulatory base, in the rest of the cases.

- Differences in the days of benefits paid. If during the review it was detected that the benefit was paid for more days than would have been due, the benefit would be recalculated and the differences would be claimed. The differences in benefit payment days may be due to different situations, in addition to those stated in sections a), b), c) and d) such as:

- Having recognized the accrual of the benefit since the beginning of the suspension, in applications received after the deadline.

- Having paid the benefit after leaving the Special Regime.

- Having paid the benefit after acquiring the status of pensioner due to retirement or permanent disability.

When the hearing process indicates that incidents have been detected on the start date of the benefit, it means that during the review of the CATA.COVID-19 benefit it has been determined that the payment of the benefit began on a date earlier than what should have corresponded (based on the information in the file).

The start date of this CATA.COVID-19 benefit depended on the date of submission of the application. Those applications submitted within the first fifteen days following the entry into force of the agreement or resolution to close the activity accrued the benefit from the day following the adoption of the measure to close the activity adopted by the competent authority; however, those submitted outside of said period accrued the benefit from the day of submission of the application.

You may justify access to the benefit from a date other than that calculated by the Mutual Fund by providing a copy or exact reference to the resolution of the competent authority that agreed to the mandatory cessation of your activity (on the date on which the benefit was recognized) and any documentation admitted by law that accredits the presentation of your application on a date other than the one valued by the mutual insurance company.

When the hearing process indicates that incidents have been detected on the end date of the benefit, it means that during the review of this CATA.COVID-19 benefit it has been determined that the payment of the benefit was finalized on a later date than it should have corresponded (based on the information in the file).

The main causes that may lead to differences in the end date of the benefit are the following:

- Have paid the benefit after it was removed from the Special Regime.

- Having paid the benefit after acquiring the status of pensioner due to retirement or permanent disability.

- The benefit having been paid later on the last day of the month in which it was agreed to lift it.

You may justify the receipt of the benefit until a date other than that calculated by the Mutual Fund in the review of this CATA.COVID-19 benefit, providing any documentation admitted by law that distorts the facts previously stated, such as:

- Updated working life report, or TGSS certificate, stating that you did not leave the special Social Security regime in the period in which you were a beneficiary of this CATA.COVID-19 benefit.

- Certificate from the INSS stating that you have not been recognized as a retirement or permanent disability pensioner in the period in which you were a beneficiary of this CATA.COVID-19 benefit.

- Copy or exact reference of the resolution of the competent authority that agreed to lift the suspension of your activity or, failing that, copy or reference of the last resolution of the competent authority that extended the suspension of your activity.

During the review process of the provisionally recognized benefit, the Mutual Fund, based on the information provided to it by the National Social Security Institute (INSS), has detected that the status of retirement or permanent disability pensioner could be recognized after the date on which this benefit began to accrue.

In order to prove that you have not acquired the status of retirement pensioner or permanent disability, you must provide a certificate from the INSS that certifies these extremes.

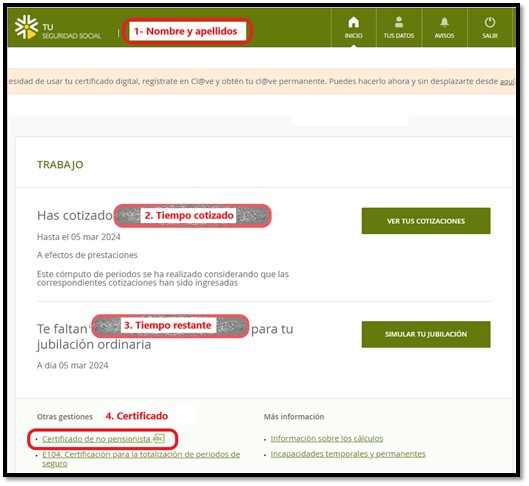

Said certificate can be obtained in the following ways:

- Request it in person at one of the Social Security Customer Service Centers (CAISS).

- Obtain it online through Your Social Security Electronic Headquarters.

Steps:

- Click on the “Interested” section and identify yourself by one of the means offered: digital certificate, Cl@ve, SMS,…).

- Save a screenshot of the information that is shown as soon as you enter, paying attention that it shows your name (at the top) and the information about contributions and the period that remains to reach ordinary retirement age.

- Request the “Non-pensioner certificate” located under the “Other procedures” section.

In any case, you can always provide any legally accepted documentation that you consider can prove that you met the conditions for access to the benefit because you are not a retirement or permanent disability pensioner.

If in the hearing process it has been indicated that possible overlaps in Social Security benefits have been detected, it is because the information provided to the Mutual Insurance Companies by the National Social Security Institute (INSS) has detected that they have been a beneficiary of some other Social Security benefit incompatible with self-employment.

Given that the Mutual Fund cannot autonomously verify this information, to refute it, you must provide along with your allegations a certificate issued by the INSS reporting the Social Security benefits that you may have received in the period in which you were a beneficiary of this CATA.COVID-19 benefit, clearly indicating: type of benefit, start date and end date.

In the event that you have not been a beneficiary of any benefit, you must provide a certificate from the INSS that expressly indicates that you have not received any Social Security benefit in the period in which you were a beneficiary of this CATA.COVID-19 benefit (except, obviously, for the latter).

If you belonged to the Special Regime of the Sea, in any case, a certificate from the Social Institute of the Navy will be necessary in which it is expressly indicated that you were not a beneficiary of aid for fleet paralysis in the period in which you were a beneficiary of this CATA.COVID-19 benefit or, if received, the exact dates on which they were received (start and end of aid).

If in the hearing process it has been indicated that possible incompatibilities have been detected with the performance of employed work or with the receipt of unemployment benefits, it is because in the information provided to the Mutuals by the General Treasury of Social Security (TGSS) and in the verifications that the Mutual has carried out autonomously, these overlaps have been detected in the period in which it was a beneficiary of this CATA.COVID-19 benefit.

You should know that the extraordinary cessation of activity benefit that was paid may be compatible with self-employment, provided that the income from self-employment does not exceed 1.25 times the amount of the Minimum Interprofessional Wage.

If this limit is exceeded, the days registered in the RGSS for performing work as an employee would be declared incompatible with the receipt of the benefit, they will be declared as unduly paid and, therefore, they would be claimed.

Alternatives to respond to this section of the hearing procedure:

- If you did not do any freelance work third party: you must provide, along with your allegations, any legally accepted documentation that refutes the facts previously stated, such as:

- An updated certificate of working life issued by the TGSS.

- A certificate from the State Public Employment Service (SEPE) stating the unemployment benefits received in the last 4 years or which expressly indicates that you were not a recipient of unemployment benefits in the period in which you were a beneficiary of this CATA.COVID-19 benefit.

- If you performed any work as an employee, but you consider that you meet the conditions for it to be compatible with the receipt of the benefit: you must provide, along with your allegations, a company certificate stating the salary received in that period or alternatively a copy of the payroll of said employees. periods.

- If you performed work as an employee that exceeded the limit of 1.25 times the SMI, you can let us know so that we can continue with the claim or not make allegations, in which case, after the deadline granted, we will also proceed to recalculate your benefit, discounting the days of pluriactivity and to claim the differences.

It is established that the receipt of this CATA.CAVID-19 benefit will be incompatible with the receipt of any return received from any company affected by the closure in which it participates or is managed.

From the data cross-checks carried out with the administration, it has been identified that he could have been linked to a company during the receipt of the CATA.COVID-19 benefit.

Since the mutual insurance company does not have access to this information directly, it is required to provide documentation to prove compliance with this requirement.

Alternatives to respond to this section of the hearing procedure:

- If during the receipt of the benefit was not linked to any company: must provide, along with its allegations, a negative certificate issued by the Commercial Registry stating that in the period in which it was a beneficiary of this CATA.COVID-19 benefit it did not maintain a corporate link with any company, nor as an administrator (failing that, they may also provide any documentation admitted by law that refutes the facts previously stated).

- If during the receipt of the benefit you administered or maintained a corporate relationship with any company affected by closure , along with your allegations you must provide:

- A certificate issued by the Commercial Registry stating the companies that it managed or with which it maintained some type of corporate relationship in the period in which it was a beneficiary of this CATA.COVID-19 benefit.

- A certificate from each of the companies certified by the Commercial Registry, indicating the returns received from each of them in each of the months in which they received the CATA.COVID-19 benefit.

The stable rule is that this CATA.COVID-19 benefit will be paid in one amount or another depending on the situation of the family unit or cohabitation.

Depending on the situation of the family or cohabitation unit, the amount of the benefit could be:

- A 40% of the regulatory base, when people united by family ties or similar cohabitation unit up to the first degree of kinship by consanguinity or affinity, and more than one member entitled to this same benefit coexist in the same home .

- A 70% of the regulatory base, in those family units that accredit the status of large family , whose only income came from the suspended self-employment activity and in which there was only a single beneficiary of this benefit .

- A 50% of the regulatory base, in the rest of the cases.

The calculation of the amount of the daily benefit that was paid was made based on the information that was provided in the application for the benefit and the responsible declaration that was attached to it.

If after reviewing this benefit you have received a hearing procedure in which it is indicated that the conditions to prove the applied percentage of 70% (in the case of a large family) or 50% (in the case of a single beneficiary) could not be verified, it will be necessary for you to prove the conditions under which you would be entitled to that percentage.

- To prove that you are the only beneficiary of this CATA.COVID-19 benefit within your family or cohabitation unit, you must provide the following documentation:

- Historical collective registration certificate or any proof admitted by law that accredits the people who made up the family or cohabitation unit on the start date of the benefit.

- Sworn declaration that no other member of the family or cohabitation unit was a beneficiary of this same benefit.

- To prove the right to receive the benefit at 70% of the regulatory base, you must prove the status of large family , that the only income of the family unit came from the suspended self-employment activity and that in the family unit there was only a single beneficiary of this benefit.

For these purposes you must provide the following documentation:- Documentation proving the status of a large family on the date on which the accrual of the benefit began.

- Historical collective registration certificate or any evidence admitted by law that certifies the people who made up the family or cohabitation unit on the start date of the benefit.

- Sworn declaration of the income of each member of the family unit and that no other member of the family or cohabitation unit was a beneficiary of this same benefit.

When the hearing process indicates that incidents have been detected on the end date of the benefit, it means that during the review of this CATA.COVID-19 benefit it has been determined that the payment of the benefit was made for an amount greater than that which would have corresponded.

In order to review your benefit again, you must provide, along with your allegations, the following documentation and information:

- Certificate of contribution bases issued by the General Security Treasury, which includes the 18 months prior to the date on which the accrual of the benefit began (or the months in which they were registered in the special regime).

- Census of Economic Activities for the year 2020, to verify the activity carried out.

4. Doubts after exceeding the deadline for the hearing process

Once the deadline granted in the hearing process has passed, the Mutual Fund will proceed to issue a final resolution evaluating the allegations and/or additional documentation that it may have received.

With the information in the file, it will issue one of the following definitive resolutions:

- Resolution that elevates the provisional agreement to final: will be issued when the allegations and/or documentation provided have allowed the detected incidents to be resolved favorably. In this case, access to the benefit and also the amounts paid will be declared correct.

- Resolution that annuls the provisional agreement: if despite the allegations and/or documentation provided they did not allow clarification of the incidents that prevented recognition of access to the benefit and, therefore, to the amounts perceived. In these cases, a resolution will be issued that revokes the provisional agreement, declares the amounts paid as undue benefits and claims said amounts in their entirety.

- Resolution that modifies the provisional agreement: will be issued when the allegations and/or documentation provided have made it possible to resolve the incidents that could prevent access to the benefit, but were not sufficient to determine that the total amount subscriber was correct. In these cases, a favorable resolution will be issued in relation to the right of access to the benefit, but it will declare that part of the benefits paid were improper, proceeding to claim the amounts paid in excess.

As informed at the end of the resolution that has been sent to you, if you are not satisfied with said resolution, you may file a prior claim through judicial channels.

The period to submit the prior claim is 30 business days (that is, excluding Saturdays, Sundays and holidays) counted from the date on which you received the resolution.

Given that this prior claim is mandatory for the initiation of subsequent judicial proceedings, we recommend that you present it by some means that reliably accredits its delivery.

Once the deadline granted in the hearing process has passed, the Mutual Fund has no obligation to analyze the allegations or documentation received. However, if your file has not yet been resolved, the Mutual Fund, in order to resolve it with as much information as possible, will analyze the documentation received (even after the deadline).

On the contrary, if the Mutual Fund receives your allegations and/or documentation once the resolution has been issued, if this is contrary to your interests, you must present a prior claim (in which you may incorporate the allegations and/or documentation that the mutual company could not assess when issuing the resolution).