Review of extraordinary benefits for cessation of activity regulated in art. 13.2 of Royal Decree-Law 30/2020, of September 29

In relation to the review of CATA.COVID-19 benefits (it is recommended to read previously), in June 2024 the review campaign of the extraordinary cessation of activity benefit for self-employed workers that was regulated in art. 13.2 of Royal Decree-Law 30/2020, of September 29, on social measures to reactivate employment and protect self-employed work and competitiveness of the industrial sector (hereinafter, PECANE 2.1).

This new benefit (PECANE 2.1) was premised on not having the necessary lack of contribution to the contingency of cessation of activity to be able to access either the extraordinary benefit regulated in the Fourth Additional Provision of this same Royal Decree-Law 30/2020, nor the ordinary benefit of cessation of activity regulated in the TRLGSS.

Fraternidad-Muprespa recognized nearly 3,200 of these benefits, for an approximate amount of about 5 million euros.

In accordance with the provisions of letters i) and j) of article 13.2 of Royal Decree-Law 30/2020, the recognition of said benefits was provisional and its definitive recognition was subject to a subsequent review.

In this review process of the provisionally recognized PECANE 2.1, various incidents or lack of information may have been detected that have prevented the mutual insurance company from elevating the provisional recognition of the benefit to definitive.

The main doubts and incidents that may arise in this review process of PECANE 2.1 are clarified below and the possible allegations and/or documentation that you can provide to clarify or correct the incidents reflected in the hearing process that you may receive are indicated.

FREQUENTLY ASKED QUESTIONS

1. Questions related to the processing of allegations

Any means of notification will be admitted to present the allegations that it deems appropriate. However, at They will provide an immediate acknowledgment of receipt and the possibility of monitoring the processing status online. Furthermore, allegations received by this means will be resolved on a preferential basis.

However, you can also send us your allegations by any other means (recommending that it be a means that reliably certifies delivery).

Consult the address of your nearest management center: Fraternidad.com/centros .

If you are the self-employed worker's advisor and have a digital office user, we recommend that you complete the allegations process by accessing the following link:

Fraternidad.com/oficinadigital

In any other case, if you do not yet have a Digital Office user, you can process allegations through the following address:

to our Digital Office, you can send us your allegations by following the steps described in this manual .

2. Questions related to access to the benefit

During the review, the following points will be analyzed:

a) Be registered in the Special Social Security Regime prior to April 1, 2020.

b) Not have a minimum gap of 12 months of contributions upon cessation of activity (CATA) immediately prior to the start of the benefit that could allow access to the extraordinary benefit of cessation of activity regulated in the 4th Additional Provision of RDL 30/2020 nor to the ordinary benefit of cessation of activity regulated in the General Law of Social Security.

c) Be up to date with the contributions with Social Security at the time the accrual of the benefit begins or have a deferral recognized prior to said date.

d) Accredit a reduction in billing during the fourth quarter of 2020 of at least 50% in relation to the first quarter of 2020.

e) In the fourth quarter of 2020, net returns may not have exceeded the Minimum Interprofessional Salary (€3,325) .

It should begin by clarifying that affiliation to Social Security is the responsibility of the General Treasury of Social Security (TGSS) and that the Mutual Fund can only access to verify the information, but cannot modify it.

As part of the verification acts in the review of this benefit, the Mutual Fund has agreed to verify the affiliation status that, today, appears in TGSS and it has been confirmed that there was no record of registration in the Special Regime prior to April 1, 2020 (or that it was canceled in said Special Regime - for more than 1 day - between April 1, 2020 and the date on which accrued the benefit).

Keep in mind that, due to the time that has passed, it could be that since you requested the benefit there has been some modification in your affiliation that affected the provisional recognition that was made to you.

In these cases, you must request a certificate from the TGSS indicating that as of April 1, 2020 you were registered in the Special Regime and that said registration has not been subsequently revoked. Alternatively, it would be enough for the TGSS to regularize the information in its database and the Mutual Fund would agree to verify it directly.

In any case, you can always provide any legally accepted documentation that you consider can prove the registration requirement in the Special Regime.

To understand this incident, you must know that the benefit that was recognized was intended for those people who did not have the lack of contributions for cessation of activity necessary to access other benefits. That is, if you had had 12 months of contributions for cessation of activity, you should have requested the extraordinary benefit for cessation of activity regulated in the fourth additional provision of Royal Decree-Law 30/2020 (POECATA 2) or, alternatively, have requested the ordinary benefit for cessation of activity regulated in the General Social Security Law (POCATA).

If you have been given a hearing for this reason, it is because the Mutual Fund, with the information to which it has had access, has not been able to prove that you did NOT have those 12 months of contributions at the cessation of activity immediately prior to the start of this benefit.

In this sense, you must take into account the following considerations:

- Since January 2019, cessation of activity coverage became mandatory for all self-employed workers, unless they were quoted at a flat rate (which, as a general rule and unless expressly chosen on their part, did not include cessation of activity coverage).

- Contributions for cessation of activity that have already been taken into account for the recognition of a cessation of activity benefit (ordinary) cannot be computed again to cover the 12-month gap in contributions for the contingency of cessation of activity.

You can prove the lack of a deficiency by providing contribution receipts from the General Social Security Treasury (TGSS), from the 12 months prior to the start of the benefit, in which the fee for cessation of activity coverage does NOT appear. You could also prove it through a certificate from the TGSS stating the periods of coverage for the contingency of cessation of activity that you have had in the last 4 years.

In any case, you can always provide any legally accepted documentation that you consider can prove that you were up to date with your Social Security contributions.

First of all, we must indicate that the debt information has been obtained from the databases of the General Treasury of Social Security (TGSS) and that the Mutual Fund only has consultation access to said data, and cannot clarify or modify said information.

To prove the non-existence of the debt, there are the following alternatives:

a) Provide a certificate from the TGSS that certifies that on 10/01/2020 you were up to date with all debts with Social Security.

b) Provide a resolution from the TGSS to defer the debt that may have been recognized as of 10/01/2020. Said resolution must be prior to 10/01/2020 and be accompanied by documentation that proves having complied, in the period 10/01/2020 to 01/30/2021, with the amortization periods indicated in the aforementioned resolution.

c) If during the receipt of the benefit you received an invitation to pay the fees owed, you may provide documentation that justifies that you were up to date with said fees within 30 days of receipt.

- Otherwise, this invitation will have been made to you along with the hearing process and, therefore, you will have 30 calendar days to pay all the debt, prior to 10/01/2020, that you owed with Social Security. If you pay said debt, you must provide proof of payment of the debt and a certificate from the TGSS that you are up to date with payment as of 10/01/2020.

- Important: For the purposes of catching up on payment of the debt prior to 10/01/2020, the recognition of a debt deferral after said date will have no effect (only the effective payment of the debt will have that effect).

In any case, you can always provide any legally accepted documentation that you consider can prove that you were up to date with your Social Security contributions.

This may be due to the fact that the Mutual Fund, with the information at its disposal, has not been able to prove that in the fourth quarter of 2020 there was a reduction in turnover of at least 50%, compared to the first quarter of 2020.

In order to verify compliance with this requirement, you must provide tax and/or accounting documentation that reliably proves the reduction in turnover required by the standard.

You can justify access to the benefit by providing the following form:

This form, in depending on the type of taxation, it must be accompanied by the following documentation:

a) Taxation by direct estimation:

General rule: they must only present forms 303 corresponding to 1 er and 4 or quarter of 2020.

Exceptions: (not required to present form 303 as a natural person).

- Administrator and/or partner: you must present form 303 of your company corresponding to the 1st er and 4 or quarter of 2020 and the documentation that proves your connection with it (partners book or registered shares registered in the commercial registry, company deeds or any means of proof admitted in law). If you are an administrator of several companies, you must present this documentation for each of them.

- Any other person not required to present form 303: must present form 036 and the sales and income book corresponding to the 1 er and 4 or quarter of 2020.

b) Taxation by objective estimate:

They must present form 131 corresponding to the 1st er and 4th or quarter of 2020, along with the sales and income book corresponding quarters (1Q2020 and 4Q2020).

Suggestion: To speed up the resolution of your file, those who have to present the sales and income book , it is recommended that they provide it in the Excel format attached to the form (although they can present it in any other format or means of evidence accepted by law).

IMPORTANT: Although in the hearing process you were only required to provide information on returns, you must also provide the information that allows you to verify the reduction in billing required by the standard. To do this, you must send us the documentation required in the previous section (question 2.5). In the case of receiving only the information on the returns, the hearing process will be given again to provide the documentation that justifies the reduction in billing.

This may be due to the fact that the Mutual Fund, with the information at its disposal, has not been able to prove that during the fourth quarter of 2020, net returns higher than the Minimum Interprofessional Wage (€3,325) were not obtained.

You can prove compliance with this requirement by providing the following form:

Said form, in Depending on the type of taxation, it must be accompanied by the following documentation:

a) Taxation by direct estimate:

General rule: only forms 130 corresponding to 3 er and 4 must be presented. or quarter of 2020.

Exceptions: (those who are not required to present form 130)

- Administrator and/or partner: must present form 190 and the list of all payrolls for the year 2020. In the case of being an administrator of several companies, you must present this documentation for each of them.

- Any other person not required to present form 130: must present form 036, the sales and income book, together with the purchase and expense book corresponding to the 4 or quarter of 2020.

b) Taxation by objective estimate:

They must present form 131 corresponding to the 4 or quarter of 2020, the sales and income book, along with the purchase and expense book corresponding to the 4 or quarter of 2020.

Suggestion: To speed up the resolution of your file, those who have to present the sales and income book, along with the purchases and expenses , it is recommended that they provide it in the Excel format attached to the form (although they can present it in any other format or means of proof accepted by law).

This may be due to the fact that the Mutual Fund, with the information at its disposal, has not been able to prove that in the fourth quarter of 2020 there was a reduction in turnover of at least 50%, compared to the first quarter of 2020; nor that during the fourth quarter of 2020, net returns greater than the Minimum Interprofessional Wage (€3,325) have not been obtained.

In these cases, the documentation related to the two previous sections must be submitted (although the form does not have to be submitted in duplicate, since the same form will serve to prove both situations).

3. Questions related to the amount of the benefit received

There are several reasons that may result in a higher benefit being paid than what should have been due. Among them, the most common are the following:

a) Overlapping with other Social Security benefits: this CATA.COVID-19 benefit is not compatible with the receipt of other Social Security benefits that, in turn, are not compatible with the development of self-employed activity. If during the receipt of this CATA.COVID-19 benefit you also benefited from other Social Security benefits (temporary disability, birth and care of a minor - former maternity/paternity -, risk during pregnancy or breastfeeding, permanent disability, retirement,...) the days in which both benefits coincided simultaneously will be deducted and claimed from this CATA.COVID-19 benefit.

b) Incompatibility with work performed as an employee and/or unemployment: this CATA.COVID-19 benefit is incompatible with the performance of work as an employee or with the receipt of unemployment benefit, when the net income from work as an employee exceeds 1.25 times the amount of the minimum interprofessional wage.

If the above limit is not exceeded, the receipt of the CATA.COVID-19 benefit would be compatible with the situation of pluriactivity.

c) Incompatibility of income received from a company: this CATA.COVID-19 benefit is incompatible with income that may have been received from any of the companies in which it participates or manages.

If during the receipt of this CATA.COVID-19 benefit you have received income from any of the companies in which you participate or manage, the months in which you have received said income will be incompatible with the receipt of the CATA.COVID-19 benefit and will be deducted and claimed from it.

d) Incompatibility with the exercise of another self-employed activity: this CATA.COVID-19 benefit is incompatible with the exercise of another self-employed activity, unless the income obtained in all professional activities carried out during the 4th quarter of 2020 does not exceed the Minimum Interprofessional Wage (€3,325) and none of said activities have started after the accrual of the benefit. CATA.COVID-19.

If the requirement is met that the net income in the 4th quarter of 2020 did not exceed the SMI (€3,325) but any of the professional activities began after the accrual of the benefit, those that had been paid after the start of the new activity will be declared as benefits unduly received.

e) Differences in the regulatory base: due to the difficulties in accessing information in the first period of the pandemic, CATA.COVID-19 benefits could be recognized with a higher regulatory base than what would have actually corresponded. If this difference had been detected during the review, the benefit would have been recalculated in accordance with the correct regulatory basis and any differences that may exist would have been claimed.

f) Differences in the daily amount paid: this may be due to having incorrectly applied the percentages that the rule established based on your family situation. The rule established that the amount of the benefit would be 50% of the regulatory base for those who were the only beneficiaries of this CATA.COVID-19 benefit within their family or cohabitation unit; and 40% on the regulatory base for the rest of the cases (more than one beneficiary of the benefit).

g) Differences in the days of benefits paid. If during the review it was detected that the benefit was paid for more days than would have been due, the benefit would be recalculated and the differences would be claimed. The differences in benefit payment days may be due to different situations, in addition to those stated in sections a), b), c) and d) such as:

- The accrual of the benefit has been recognized since 10/01/2020, in applications received after the deadline.

- Having paid the benefit after leaving the Special Regime.

- Having paid the benefit after acquiring the status of pensioner due to retirement or permanent disability.

When in the hearing process it is indicated that incidents have been detected on the start date of the benefit, it means that during the review of the CATA.COVID-19 benefit it has been determined that the payment of the benefit began on a date earlier than what should have corresponded (based on the information in the file).

The start date of this CATA.COVID-19 benefit depended on the date of submission of the application. Those applications submitted before 10/15/2020 (inclusive) accrued the benefit from 10/01/2020, the rest accrued the benefit from the first day of the month following that of their presentation.

You may justify access to the benefit from a date other than the one calculated by the Mutual Fund by providing any legally accepted documentation that proves the submission of your application on a date other than that assessed by the mutual insurance company.

When in the hearing process it is indicated that incidents have been detected on the end date of the benefit, it means that during the review of this CATA.COVID-19 benefit it has been determined that the payment of the benefit was finalized on a later date than it should have corresponded (based on the information in the file).

The main causes that may lead to differences in the end date of the benefit are the following:

- Having paid the benefit until after it caused withdrawal from the Special Regime.

- Having paid the benefit after acquiring the status of pensioner due to retirement or permanent disability.

You may justify access to the benefit until a date other than that calculated by the Mutual Fund in the review of this CATA.COVID-19 benefit, providing any documentation admitted by law that distorts the facts previously stated, such as:

- Updated work life report, or TGSS certificate, stating that you did not leave the special Social Security regime in the period 10/01/2020 to 01/30/2021.

- Certificate from the INSS stating that the status of a retirement pensioner or permanent disability has not been recognized in the period 10/01/2020 to 01/30/2021.

During the review process of the provisionally recognized benefit, the Mutual Fund, based on the information provided to it by the National Social Security Institute (INSS), has detected that the status of retirement or permanent disability pensioner could be recognized after the date on which this benefit began to accrue.

In order to prove that you have not acquired the status of retirement pensioner or permanent disability, you must provide a certificate from the INSS that certifies these extremes.

Said certificate can be obtained in the following ways:

- Request it in person at one of the Social Security Customer Service Centers (CAISS).

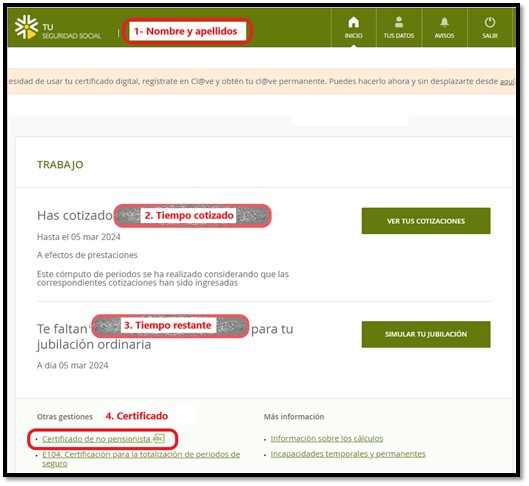

- Obtain it online through Your Social Security Electronic Headquarters.

Steps:

- Click on the “Interested” section and identify yourself by one of the means offered: digital certificate, Cl@ve, SMS,…).

- Save a screenshot of the information that is shown as soon as you enter, paying attention that it shows your name (at the top) and the information about contributions and the period that remains to reach ordinary retirement age.

- Request the “Non-pensioner certificate” located under the “Other procedures” section.

In any case, you can always provide any legally accepted documentation that you consider can prove that you met the conditions for access to the benefit because you are not a retirement or permanent disability pensioner.

If in the hearing process it has been indicated that possible overlaps in Social Security benefits have been detected, it is because the information provided to the Mutual Insurance Companies by the National Social Security Institute (INSS) has detected that they have been a beneficiary of some other Social Security benefit incompatible with self-employment.

Given that the Mutual Fund cannot autonomously verify this information, to refute it, it must provide, along with its allegations, a certificate issued by the INSS reporting the Social Security benefits that it may have received in the period 10/01/2020 to 01/30/2021, clearly indicating: type of benefit, start date and end date.

In the event that you have not been a beneficiary of any benefit, you must provide a certificate from the INSS that expressly indicates that you have not received any Social Security benefit in the period 10/01/2020 to 01/30/2021 (except, obviously, for this CATA.COVID-19 benefit).

If you belong to the Special Regime of the Sea, in any case, a certificate from the Social Institute of the Navy will be necessary in which it is expressly indicated that you were not a beneficiary of the aid for fleet paralysis in the period 10/01/2020 to 01/30/2021 or, if you received them, the exact dates on which you received them (start and end of the aid).

If in the hearing process it has been indicated that possible incompatibilities have been detected with the performance of employed work or with the receipt of unemployment benefits, it is because in the information provided to the Mutual Funds by the General Treasury of Social Security (TGSS) and in the verifications that the Mutual Fund has carried out autonomously, these overlaps have been detected in the period 10/01/2020 to 01/30/2021.

You should know that the extraordinary cessation of activity benefit that was paid may be compatible with employed work, as long as the income from employed work does not exceed 1.25 times the amount of the Minimum Interprofessional Wage.

If this limit is exceeded, the days registered in the RGSS for performing work as an employee would be declared incompatible with the receipt of the benefit, they will be declared as unduly paid and, therefore, they would be claimed.

Alternatives to respond to this section of the hearing procedure:

- If you did not do any work as an employee: you must provide, along with your allegations, any documentation admitted by law that refutes the facts previously stated, such as:

- An updated certificate of working life issued by the TGSS.

- A certificate from the State Public Employment Service (SEPE) stating the unemployment benefits received in the last 4 years or which expressly indicates that you were not a recipient of unemployment benefits in the period 10/01/2020 to 01/30/2021.

- If you performed any work as an employee, but you consider that you meet the conditions for it to be compatible with the receipt of the benefit: you must provide, along with your allegations, a company certificate stating the salary receipts received in that period or alternatively a copy of the payroll for said periods.

- If you performed work as an employee that exceeded the limit of 1.25 times the SMI, you can let us know so that we can continue with the claim or not make allegations, in which case, after the deadline granted, we will also proceed to recalculate your benefit, discounting the days of multiple activity and claim the differences.

It is established that the receipt of this CATA.CAVID-19 benefit will be incompatible with the development of any new activity that begins after the accrual of the benefit.

Given that the mutual insurance company does not have access to this information, information is required to prove that it did not carry out any activity after the benefit accrued. For these purposes, you must provide us with the Census of business activities for 2020 and 2021.

If in said census any activity appears that you did not carry out, you may provide any evidence admitted by law that proves that you did not really carry out said activity despite it appearing related in the census of business activities provided.

It is established that the receipt of this CATA.CAVID-19 benefit will be incompatible with the receipt of any return received from a company in which one participates or manages.

From the data cross-checks carried out with the administration, it has been identified that he could have been linked to a company during the receipt of the CATA.COVID-19 benefit.

Since the mutual insurance company does not have access to this information directly, it is required to provide documentation to prove compliance with this requirement.

Alternatives to respond to this section of the hearing procedure:

- If during the receipt of the benefit you were not linked to any company: you must provide, along with your allegations, a negative certificate issued by the Commercial Registry stating that between 10/01/2020 and 01/31/2021 you did not maintain a corporate link with any company, nor as an administrator (Failing this, they may also provide any legally accepted documentation that refutes the facts stated above).

- If during the receipt of the benefit you managed or maintained a corporate relationship with any company, along with your allegations you must provide:

- A certificate issued by the Commercial Registry stating the companies that you managed or with which you maintained some type of corporate relationship between 10/01/2020 and 01/31/2021.

- A certificate from each of the companies certified by the Commercial Registry, indicating the returns received from each of them in each of the months in which the CATA.COVID-19 benefit was received.

The stable rule is that this CATA.COVID-19 benefit will be paid in one amount or another depending on whether within the family or cohabitation nucleus there are one or more beneficiaries of this benefit. If you were the only recipient of the benefit within your family or cohabitation unit, you would have the right to receive the benefit in a daily amount that would be calculated by applying 50% to the regulatory base that corresponded to you. However, if in your family or cohabitation unit in addition to you there had been another member who received the same benefit, everyone should have received the benefit in a daily amount calculated on 40% of the regulatory base that corresponded to each one.

The calculation of the amount of the daily benefit that was paid was made based on the information that was provided in the application for the benefit and the responsible declaration that was attached to it.

If after reviewing this benefit you have received a hearing procedure indicating that the percentage applied to the regulatory base was 50%, without being proven that any of the cohabitants in your domicile in 2020 had been a recipient of this same extraordinary benefit due to cessation of activity, you will need to prove this situation.

To prove that you are the only beneficiary of this CATA.COVID-19 benefit within your family or cohabitation unit, you must provide the following documentation:

- Historical collective registration certificate or any proof admitted by law that accredits the people who made up the family or cohabitation unit on the start date of the benefit.

- Sworn declaration that no other member of the family or cohabitation unit was a beneficiary of this same benefit.

When in the hearing process it is indicated that incidents have been detected on the end date of the benefit, it means that during the review of this CATA.COVID-19 benefit it has been determined that the payment of the benefit was made for an amount greater than that which would have corresponded.

In order to review your benefit again, you must provide, along with your allegations, the following documentation and information:

- Certificate of contribution bases issued by the General Security Treasury, which shows the 18 months prior to July 2020 (or the months in which you were registered in the special regime).

- Certificate of Status in the AEAT census of economic activities.

4. Doubts after exceeding the deadline for the hearing process

Once the deadline granted in the hearing process has passed, the Mutual Fund will proceed to issue a final resolution evaluating the allegations and/or additional documentation that it may have received.

With the information in the file, it will issue one of the following definitive resolutions:

a) Resolution that elevates the provisional agreement to final: it will be issued when the allegations and/or documentation provided have allowed the incidents detected to be resolved favorably. In this case, access to the benefit and also the amounts paid will be declared correct.

b) Resolution that annuls the provisional agreement: if, despite the allegations and/or documentation provided, they do not allow clarification of the incidents that prevented recognition of access to the benefit and, therefore, to the amounts received. In these cases, a resolution will be issued that revokes the provisional agreement, declares the amounts paid as undue benefits and claims said amounts in their entirety.

c) Resolution that modifies the provisional agreement: will be issued when the allegations and/or documentation provided have made it possible to resolve the incidents that could prevent access to the benefit, but were not sufficient to determine that the total amount paid was correct. In these cases, a favorable resolution will be issued in relation to the right of access to the benefit, but it will declare that part of the benefits paid were improper, proceeding to claim the amounts paid in excess.

As informed at the end of the resolution that has been sent to you, if you are not satisfied with said resolution, you may file a prior claim through judicial channels.

The period to submit the prior claim is 30 business days (that is, excluding Saturdays, Sundays and holidays) counted from the date on which you received the resolution.

Given that this prior claim is mandatory for the initiation of subsequent judicial proceedings, we recommend that you present it by some means that reliably certifies its delivery.

Once the deadline granted in the hearing process has passed, the Mutual Fund has no obligation to analyze the allegations or documentation received. However, if your file has not yet been resolved, the Mutual Fund, in order to resolve it with as much information as possible, will analyze the documentation received (even after the deadline).

On the contrary, if the Mutual Fund receives your allegations and/or documentation once the resolution has been issued, if this is contrary to your interests, you must present a prior claim (in which you may incorporate the allegations and/or documentation that the mutual company could not assess when issuing the resolution).