Review of extraordinary benefits for cessation of activity regulated in art. 9 of Royal Decree-Law 24/2020, of June 26

In relation to the review of CATA.COVID-19 benefits (previous reading is recommended) , in March 2024 the campaign to review the extraordinary cessation of activity benefit for self-employed workers, which was regulated in article 9 of Royal Decree-Law 24/2020 , of June 26, social measures to reactivate employment and protect self-employed work and competitiveness of the industrial sector (hereinafter, POECATA 1).

This new benefit (POECATA 1) was premised on having been a beneficiary until June 30, 2020 of the extraordinary benefit for cessation of activity regulated in the first package of measures (the so-called PECATA) and allowed make the receipt of the benefit compatible with the performance of self-employment, meeting a series of requirements.

In accordance with the provisions of section 3 of art. 9 of Royal Decree-Law 24/2020, the recognition of said benefits was provisional and its definitive recognition was subject to a subsequent review.

In this review process of the provisionally recognized POECATA 1, various incidents or lack of information may have been detected that have prevented the mutual from elevating the provisional recognition of the benefit to definitive.

The main doubts and incidents that may arise in this POECATA 1 review process are clarified below and the possible allegations and/or documentation that you can provide to clarify or correct the incidents reflected in the hearing process that you may receive are indicated.

FREQUENTLY ASKED QUESTIONS

1. Questions related to the processing of allegations

Any means of notification will be admitted to present the allegations that it deems appropriate. However, at

Requests received by this means will provide you with immediate acknowledgment of receipt and the possibility of monitoring the processing status online. Furthermore, allegations received by this means will be resolved on a preferential basis.

However, you can also send us your allegations by any other means (recommending that it be a means that reliably accredits delivery).

Consult the address of your nearest management center: Fraternidad.com/centros

If you are the self-employed worker's advisor and have a digital office user, we recommend that you complete the allegation process by accessing the following link: Fraternidad.com/o ficinadigital

En cualquier otro caso, si aún no dispone de usuario de Oficina Digital, podrá realizar el trámite de alegaciones a través de la siguiente dirección: this manual .

2. Questions related to access to the benefit

During the review the following points will be analyzed:

- Having been a recipient until June 30, 2020 of the PECATA (extraordinary benefit for cessation of activity regulated in article 17 of RD-law 8/2020, of March 17) and maintaining said situation after the review that the Mutual Fund may have carried out.

- Be registered in the Special Social Security Regime at the time the accrual of the benefit begins.

- Have with a minimum contribution gap of 12 months upon cessation of activity (CATA) immediately prior to the start of the benefit.

- Be up to date with the contributions with Social Security at the time the accrual of the benefit begins or have a deferral recognized prior to said date.

- At the time of requesting the benefit, comply with all labor and Social Security obligations that you assumed with respect to all the workers under your care (if you have them).

- Not being retired, nor having reached the ordinary age to access it (unless you do not have the necessary contributions to access retirement).

- Accredit a reduction in billing during the third quarter of 2020 of at least 75% in relation to the same period of 2019.

- Not having obtained during the third quarter of 2020 net returns exceeding €5,818.75 (nor that the proration of the net returns for said quarter exceeds €1,939.58/month).

This incident can be due to various reasons, the most common being the following:

- You were paid the PECATA due to reduced billing and you were discharged from the Special Regime with prior to June 30, 2020.

- You requested the termination or renunciation of the benefit prior to June 30, 2020.

- He became a retirement or permanent disability pensioner (incompatible with the development of his self-employed professional activity) prior to June 30, 2020.

- He had a deferral of debts for contributions and during the period 03/14/2020 to 06/30/2020 failing to meet any of the amortization deadlines and not paying off the remaining debt in the following 30 days.

- After the recent review of the provisionally recognized PECATA, some incident has been detected that has prevented recognition that the benefit was correctly recognized or paid until 06/30/2020.

In this case, you may provide any legally accepted documentation that you consider can prove that you were a beneficiary of PECATA until 06/30/2020 and that said recognition has not been altered after the review of the provisional agreement.

It should begin by clarifying that affiliation to Social Security is the responsibility of the General Treasury of Social Security (TGSS) and that the Mutual Fund can only access to verify the information, but cannot modify it.

As part of the verification acts in the review of this benefit, the Mutual Fund has agreed to verify the affiliation status that, today, appears in TGSS for the date of access to the benefit. It could be that since you requested the benefit there has been some modification in your affiliation that affected the provisional recognition that was given to you.

In these cases, you must request from the TGSS a certificate indicating that as of 07/01/2020 you were registered in the Special Regime and that said registration has not been subsequently revoked. Alternatively, it would be enough for the TGSS to regularize the information in its database and the Mutual Fund would agree to verify it directly.

In any case, you can always provide any documentation admitted by law that you consider can prove the registration requirement in the Special Regime.

This incident determines that the Mutual Fund, with the information to which it has had access, has not been able to prove that it has contributed for the contingency of cessation of activity during, at least, the 12 months immediately prior to the start of this benefit.

In this sense, you must take into account the following considerations:

- If it was quoted on a flat rate, as a general rule and unless expressly chosen by you, said flat rate did not include coverage for cessation of activity.

- Contributions for cessation of activity that have already been taken into account for the recognition of a cessation of activity benefit (ordinary) cannot be computed again to cover the 12-month gap in contributions for the contingency of cessation of activity.

You can prove the deficiency by providing contribution receipts from the General Treasury of Social Security (TGSS), from the 12 months prior to the start of the benefit, which show the fee for cessation of activity coverage. You could also prove it through a certificate from the TGSS stating the periods of coverage for the contingency of cessation of activity that you have had in the last 4 years.

In any case, you can always provide any legally accepted documentation that you consider can prove that you were up to date with your Social Security contributions.

First of all, we must indicate that the debt information has been obtained from the databases of the General Treasury of Social Security (TGSS) and that the Mutual Fund only has consultation access to said data, and cannot clarify or modify said information.

To prove the non-existence of the debt there are the following alternatives:

- Provide a certificate from the TGSS that certifies that on the date 07/01/2020 was up to date with all debts with Social Security.

- Provide a resolution from the TGSS to defer the debt that may have been recognized as of 07/01/2020. Said resolution must be prior to 07/01/2020 and be accompanied by documentation that proves having complied, in the period 07/01/2020 to 09/30/2020, with the amortization periods indicated in the aforementioned resolution.

- If during the receipt of the benefit you received an invitation to pay the owed installments, you may provide documentation justifying that you were up to date with said installments within 30 days of receipt.

- Otherwise, said invitation will have been made along with the hearing process and, therefore, you will have 30 calendar days to pay all the debt, prior to 07/01/2020, that you owed with Social Security. If you pay said debt, you must provide proof of payment of the debt and a certificate from the TGSS that you are up to date with payment as of 07/01/2020.

Important: For the purposes of catching up on payment of the debt prior to 07/01/2020, the recognition of a debt deferral after said date will have no effect (only the effective payment of the debt will have that effect).

- Otherwise, said invitation will have been made along with the hearing process and, therefore, you will have 30 calendar days to pay all the debt, prior to 07/01/2020, that you owed with Social Security. If you pay said debt, you must provide proof of payment of the debt and a certificate from the TGSS that you are up to date with payment as of 07/01/2020.

In any case, you can always provide any legally accepted documentation that you consider can prove that you were up to date with your Social Security contributions.

First of all, we must indicate that this information has been provided to us by the General Treasury of Social Security (TGSS) itself and that the Mutual Fund does not have the option of verifying these details.

In these cases, you must request from the TGSS a certificate indicating that at the time of requesting the benefit (art. 9.1 of RDL 24/2020) you were up to date with the labor and Social Security obligations of the workers under your care.

In any case, you can always provide any legally accepted documentation that you consider can prove that you were up to date with your Social Security contributions.

The benefit that is being reviewed cannot be recognized for those workers who, at the time of requesting the benefit, were retirement pensioners or had the normal retirement age and the necessary contributions to do so.

During the review process of the provisionally recognized benefit, the Mutual Fund has detected that he was a retirement pensioner prior to 07/01/2020 or that, due to his age, he could be a possible beneficiary of said pension. In this sense, the Mutual Fund, not having all the information, presumes that the retirement age is 65 years and that it has the necessary eligibility to access the benefit.

In order to prove that you did not have the status of a retirement pensioner or that you had not reached the ordinary retirement age or that you did not have the necessary deficiency to access said pension, you must provide a certificate from the National Social Security Institute (INSS) that certifies these extremes.

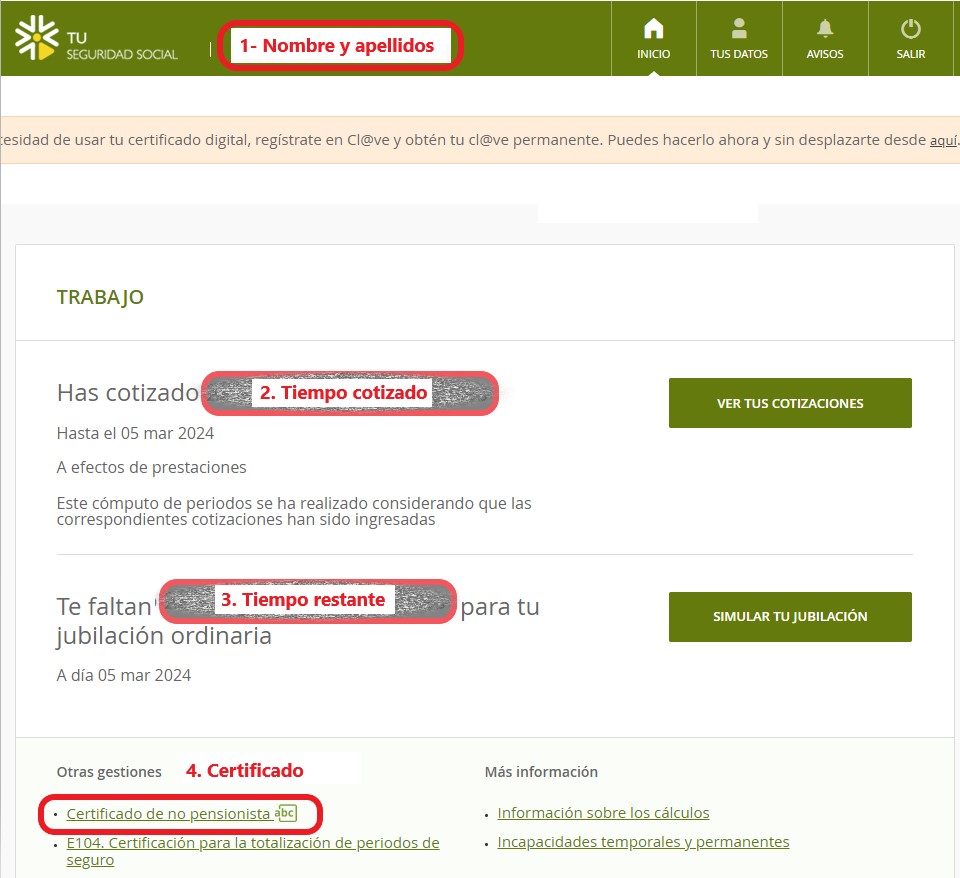

This certificate can be obtained in the following ways:

- Request it in person at one of the Social Security Stakeholder Attention Centers (CAISS).

- Obtain it online through Your Social Security Electronic Headquarters .

Steps:

- Click on the “Interested” section and identify yourself by one of the means offered: digital certificate, Cl@ve, SMS,…).

- Save a screenshot of the information that is shown as soon as you enter, paying attention that it shows your name (at the top) and the information about contributions and the period remaining to reach ordinary retirement age.

- Request the “Non-pensioner certificate” located under the “Other procedures” section.

In any case, you can always provide any documentation admitted by law that you consider can prove that you met the conditions of access to the benefit because you are not a retirement pensioner, nor do you have the ordinary age to access it or do not have the necessary contributions to request it.

This may be because the Mutual Fund, with the information at its disposal, has not been able to prove that in the third quarter of 2020 there was a reduction in turnover of at least 75%, compared to the third quarter of 2019.

In relation to the billing reduction requirement, this may be met in one of the following ways:

- The reduction will be presumed accredited , without having to provide any type of additional documentation , when the professional activity carried out during the third quarter of 2020 was among those that experienced a reduction of more than 7.5% in the average daily number of active workers affiliated with the Social Security system, during the period of receipt of the benefit, in relation to the third quarter of 2019 (Second additional provision of Royal Decree-Law 3/2021, of 2 February).

- Providing tax and/or accounting documentation that reliably proves the billing reduction required by the standard.

You can justify access to the benefit by providing the following form:

This form, depending on the type of taxation, must be accompanied by the following documentation:

a) Taxation by direct estimation:

General rule: they should only present the 303 forms corresponding to the 3rd er quarter of the years 2019 and 2020.

Exceptions: (not required to present form 303 as a natural person).

- Administrator and/or partner: you must present form 303 of your company corresponding to the 3 er quarter of the years 2019 and 2020 and the documentation that proves your connection with it (partner's book or registered shares registered in the commercial registry, company deeds or any means of proof admitted by law). If you are an administrator of several companies, you must present this documentation for each of them.

- Any other person not required to present form 303: must present form 036 and the sales and income book corresponding to the 3rd er quarter of the years 2019 and 2020.

b) Taxation for objective estimate:

They must present form 131 corresponding to the 3rd er quarter of the years 2019 and 2020, along with the sales and income book corresponding to the 3rd er quarter for the years 2019 and 2020.

Suggestion: To speed up the resolution of your file, those who have to present the sales and income book , It is recommended that they provide it in the Excel format attached to the form (although they can present it in any other format or means of evidence accepted by law).

Alternatively to the above means, you may also justify access to the benefit by alleging and documenting that the activity you carried out and justified your inclusion in the Special Regime was different from the one you Mutua has evaluated in its review and that it was actually one of the activities affected by the reduction of more than 7.5% in the average daily number of active workers affiliated with the Social Security system, during the period of receipt of the benefit, in relation to the third quarter of 2019 (second additional provision of Royal Decree-Law 3/2021, of February 2).

In this case you must regularize your situation in the TGSS and provide the following documentation:

- Document of the TGSS that accredits the new activity and covers the period 07/01/2020 to 09/30/2020.

- Economic activities tax for the year 2020.

- Any other document admitted by law that accredits or endorses the exercise of the activity that you intend to allege.

This may be because the Mutual Fund, with the information at its disposal, has not been able to prove that during the third quarter of 2020 net returns greater than €5,818.75 have not been obtained (nor that the proration of net returns in said quarter exceeds of €1,939.58/month).

You can prove compliance with this requirement by providing the following form:

Said form, depending on the type of taxation, must be accompanied by the following documentation:

a) Taxation by direct estimation:

General rule: only They must present the 130 forms corresponding to the 2nd or and 3rd er quarter of 2020.

Exceptions: (those who are not required to submit form 130)

- Administrator and/or partner: must submit form 190 and the list of all payrolls of the year 2020. In the case of being an administrator of several companies, you must present this documentation for each of them.

- Any other person not required to present form 130: must present form 036, the sales and income book, together with the purchases and expenses book corresponding to the 3rd er quarter of 2020.

b) Taxation by objective estimate:

They must present the model 131 corresponding to the 3rd er quarter of 2020, the sales and income book, together with the purchase and expense book corresponding to the 3 er quarter of 2020.

Suggestion: To speed up the resolution of your file, those who have to present the sales and income books, along with the purchases and expenses , it is recommended that they provide it in the Excel format attached to the form (although they can present it in any other format or means of proof accepted in right).

This may be due to the fact that the Mutual Fund, with the information at its disposal, has not been able to prove that in the third quarter of 2020 there was a reduction in turnover of at least 75%, compared to the third quarter of 2019; nor that during the third quarter of 2020 net returns greater than €5,818.75 have not been obtained (nor that the proration of net returns in said quarter exceeds €1,939.58/month) .

In these cases, the documentation related to the two previous sections must be submitted (although the form does not have to be submitted in duplicate, since the same form will serve to prove both situations).

3. Questions related to the amount of the benefit received

There are several reasons that may result in a higher benefit being paid than what should have been due. Among them, the most common are the following:

a) Overlapping with other Social Security benefits: this CATA.COVID-19 benefit is not compatible with the receipt of other Social Security benefits which, in its opinion, time, were not compatible with the development of the activity on one's own account. If during the receipt of this CATA.COVID-19 benefit you also benefited from other Social Security benefits (temporary disability, birth and care of a minor - former maternity/paternity -, risk during pregnancy or breastfeeding, permanent disability, retirement,...) the days in which both benefits coincided simultaneously will be deducted and claimed from this CATA.COVID-19 benefit.

b) Incompatibility with work performed as an employee and/or unemployment: this CATA.COVID-19 benefit is incompatible with the performance of work as an employee or with the perception of unemployment benefit. Consequently, if during the receipt of this benefit you also performed employed work or were a beneficiary of unemployment benefits, the CATA.COVID-19 benefit days overlapping with the previous situations and that had not already been deducted by the mutual insurance company at the time, will be claimed now.

c) Differences in the regulatory base: due to the difficulties of access to information in the first period of the pandemic, CATA.COVID-19 benefits could be recognized with a regulatory base higher than what was actually would have corresponded. If this difference had been detected during the review, the benefit would have been recalculated in accordance with the correct regulatory basis and any differences that may exist would have been claimed.

d) Differences in the daily amount paid: exceptionally this may be due to having incorrectly applied the maximum and minimum limits established for this benefit (depending on the IPREM and the number of dependent children).

e) Differences in the days of benefits paid. If during the review it was detected that the benefit was paid for more days than would have been due, the benefit would be recalculated and the differences would be claimed. The differences in benefit payment days may be due to different situations, in addition to those stated in sections a) and b), such as:

- Having recognized the accrual of the benefit since 07/01/2020, in applications received after the deadline.

- Having paid the benefit until 09/30/2020, when you previously left the Special Regime.

- Having paid the benefit after reaching the ordinary retirement age, or having become a retirement pensioner or permanent disability.

When the hearing process indicates that incidents have been detected on the start date of the benefit, it means that during the review of the CATA.COVID-19 benefit it has been determined that the payment of the benefit began on a date earlier than what should have corresponded (based on the information in the file).

The start date of this CATA.COVID-19 benefit depended on the date of submission of the application. Those applications submitted before 07/15/2020 accrued the benefit from 07/01/2020, the rest accrued the benefit from the day following their presentation.

You may justify access to the benefit from a date other than the one calculated by the Mutual Fund by providing any legally accepted documentation that proves the submission of your application on a date other than the one assessed by the mutual insurance company.

When the hearing process indicates that incidents have been detected on the end date of the benefit, it means that during the review of this CATA.COVID-19 benefit it has been determined that the payment of the benefit was finalized on a later date than it should have corresponded (based on the information in the file).

The main causes that may lead to differences in the end date of the benefit are the following:

- Have paid the benefit until 09/30/2020, when he previously dropped from the Special Regime.

- Having paid the benefit after reaching the ordinary retirement age, or having become a retirement pensioner or permanent disability.

You may justify access to the benefit until a date other than that calculated by the Mutual Fund in the review of this CATA.COVID-19 benefit, providing any legally accepted documentation that refutes the facts previously stated, such as:

- Updated working life report, or TGSS certificate, stating that you did not leave the special Social Security regime in the period 07/01/2020 to 09/30/2020.

- Certificate from the INSS stating that you have not been recognized as a retirement pensioner or due to permanent disability in the period 07/01/2020 to 09/30/2020 (or, where appropriate, prove that even though you are of the ordinary age to access the pension does not have sufficient contributions).

If in the hearing process it has been indicated that possible overlaps in Social Security benefits have been detected, it is because the information provided to the Mutual Insurance Companies by the National Social Security Institute (INSS) has detected that they have been a beneficiary of some other Social Security benefit incompatible with self-employment.

Given that the Mutual Fund cannot autonomously verify this information, to refute it, you must provide along with your allegations a certificate issued by the INSS reporting the Social Security benefits that you may have received in the period 07/01/2020. 09/30/2020 clearly indicating: type of benefit, start date and end date.

In the event that you have not been a beneficiary of any benefit, you must provide a certificate from the INSS that expressly indicates that you have not received any Social Security benefit in the period 07/01/2020 to 09/30/2020 (except, obviously, this benefit CATA.COVID-19).

If you belong to the Special Regime of the Sea, in any case, a certificate from the Social Institute of the Navy will be necessary in which it is expressly indicated that you were not a beneficiary of aid due to fleet paralysis in the period 07/01/2020 to 09/30/2020 or, if you received them, the exact dates on which you received them (start and end of aid).

If in the hearing process it has been indicated that possible incompatibilities have been detected with the performance of employed work or with the receipt of unemployment benefits, it is because in the information provided to the Mutuals by the General Treasury of Social Security (TGSS) and in the verifications that the Mutual has carried out autonomously these overlaps have been detected in the period 07/01/2020 to 09/30/2020.

To refute this information, you must provide, along with your allegations, any documentation admitted by law that refutes the facts previously stated, such as:

- An updated certificate of working life issued by the TGSS.

- A certificate from the State Public Employment Service (SEPE) stating the unemployment benefits received in the last 4 years or which expressly indicates that you were not a recipient of unemployment benefits in the period 07/01/2020 to 09/30/2020.

When the hearing process indicates that incidents have been detected on the end date of the benefit, it means that during the review of this CATA.COVID-19 benefit it has been determined that the payment of the benefit was made for an amount greater than that which would have corresponded.

In order to review your benefit again, you must provide, along with your allegations, the following documentation and information:

- Certificate of contribution bases issued by the General Security Treasury, which includes the 18 months prior to July 2020 (or the months in which you were registered in the special regime).

- Family book, to verify the number of dependent children.

- Economic Activities Tax for the year 2020, to verify the activity carried out.

4. Doubts after exceeding the deadline for the hearing process

Once the deadline granted in the hearing process has passed, the Mutual Fund will proceed to issue a final resolution evaluating the allegations and/or additional documentation that it may have received.

With the information in the file, it will issue one of the following definitive resolutions:

a) Resolution that elevates the provisional agreement to final: will be issued when the allegations and/or documentation provided have allowed the detected incidents to be resolved favorably. In this case, access to the benefit and also the amounts paid will be declared correct.

b) Resolution that annuls the provisional agreement: if, despite the allegations and/or documentation provided, they do not allow clarification of the incidents that prevented recognition of access to the benefit and, therefore, to the amounts received. In these cases, a resolution will be issued that revokes the provisional agreement, declares the amounts paid as undue benefits and claims said amounts in their entirety.

c) Resolution that modifies the provisional agreement: will be issued when the allegations and/or documentation provided have made it possible to resolve the incidents that could prevent access to the benefit, but were not sufficient to determine that the total amount paid was correct. In these cases, a favorable resolution will be issued in relation to the right of access to the benefit, but it will declare that part of the benefits paid were improper, proceeding to claim the amounts paid in excess.

As informed at the end of the resolution that has been sent to you, if you are not satisfied with said resolution, you may file a prior claim through judicial channels.

The period to submit the prior claim is 30 business days (that is, excluding Saturdays, Sundays and holidays) counted from the date on which you received the resolution.

Given that this prior claim is mandatory for the initiation of subsequent judicial proceedings, we recommend that you present it by some means that reliably accredits its delivery.

Once the deadline granted in the hearing process has passed, the Mutual Fund has no obligation to analyze the allegations or documentation received. However, if your file has not yet been resolved, the Mutual Fund, in order to resolve it with as much information as possible, will analyze the documentation received (even after the deadline).

On the contrary, if the Mutual Fund receives your allegations and/or documentation once the resolution has been issued, if this is contrary to your interests, you must present a prior claim (in which you may incorporate the allegations and/or documentation that the mutual company could not assess when issuing the resolution).

5. Examples of how to fill out the allegations form to prove the reduction in billing

Available soon