News in our Digital Office for companies, freelancers and advisors

Since the launch of the service to request the extraordinary benefit for the self-employed due to COVID-19 on April 5, we have been incorporating improvements in the Digital Office to facilitate the processing for consultancies and self-employed workers and provide more complete information to companies.

We have adapted the Digital Office so that advisors and self-employed workers can download the certificate of recognition of the extraordinary benefit and the Company Prevention Services can obtain additional information about the COVID-19 processes

These are the improvements introduced:

1.- The service offers a good part of the application data pre-filled, based on what we have in our information systems, which results in greater agility and convenience during processing.

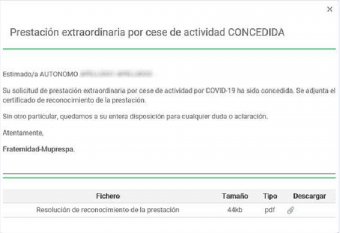

2.- Download certificates of recognition of the CATA.COVID-19 benefit from the Digital Office. (Image 1)

The consultancies, by accessing the menu option “Economic benefits – Self-employed benefits” have the option of knowing, through a quick filter, what benefits and what type the worker is granted. If the CATA.COVID-19 benefit has been granted, the award document is available for download.

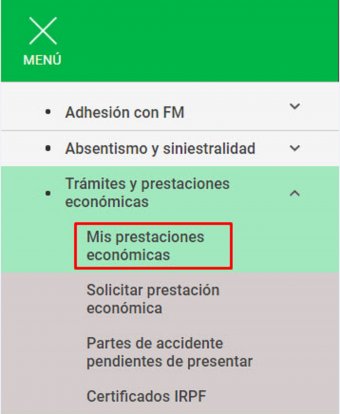

For consultancies that have 10 or more self-employed workers with COVID-19 benefits granted, they can download all the certificates of recognition of the benefit at once through the Digital Office, in a single file, which contains all the certificates, which represents a significant time saving. (Image 2)

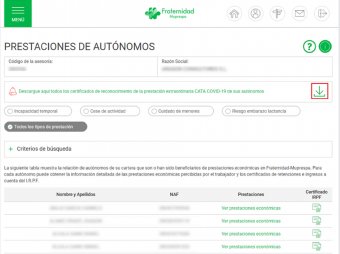

The self-employed can also download their certificate of recognition of this benefit. To do this they have to access the menu “Procedures and financial benefits – My financial benefits” (Image 3)

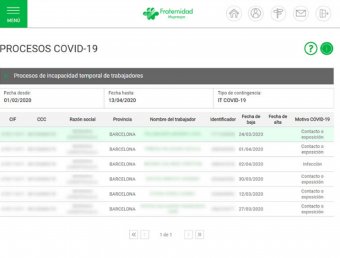

3.- A new control report has also been included in the Digital Office so that consultancies and associated companies can obtain the list of workers who are or have been on sick leave due to temporary disability due to COVID-19, useful information both for the prevention services of companies, which need this information to carry out their health surveillance function and when preparing payrolls (since IT deductions have the peculiarity that they must be calculated as if it were a professional contingency). will be discussed).

You can request that the report include processes whose removal or registration date is in a specific time period, or processes that have a withdrawal day in the period. By selecting “Consult”, the system shows the complete list of workers in an IT situation due to contact, exposure or infection by COVID-19. By selecting “Generate Report” the user obtains a detailed report with the list of workers in spreadsheet format. The report contains, among others, data such as the company's CIF, its company name and province, worker data, type of contingency, reason for being on sick leave ("Contact or exposure" or "Infection") and dates of the temporary disability process. (Image 4)

4.- As part of better usability of the Digital Office for its users, new search criteria have also been introduced in the “Managed mutualists” section, for example, Social Security affiliation number, identity document identifier and name and surname. In this way, the consultancy can easily locate specific freelancers in its portfolio. (Image 5)

The “Benefits” link has been added in the self-employed records, to consult the economic benefits of any type that the self-employed person has been granted: Cessation of Self-Employed Worker Activity (CATA), Temporary Disability (IT), Risk in Pregnancy or Breastfeeding (PREL) or Care of Minors (CUME), in addition to the one already mentioned by CATA COVID-19.