RED mechanisms

What is the Network Mechanism?

It is an instrument of sustainability and stabilization of employment that allows companies to request measures to reduce working hours and temporarily suspend employment contracts.

The request for the benefit will be possible after activation of the RED Mechanism by Agreement of the Council of Ministers and only while it remains activated.

What are the types of modalities that the self-employed can benefit from?

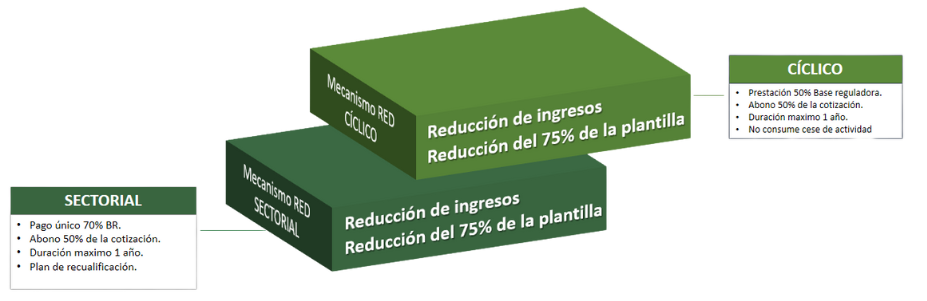

- Cyclical: when a general macroeconomic situation is observed that recommends its activation, with a maximum duration of one year.

- Sectoral: when in a certain sector or sectors of activity there are permanent changes that generate needs for requalification and professional transition processes of workers, with a maximum initial duration of one year and a single payment.

Common Requirements

- Registration in the Special Regime (according to the activity)

- Payment Current with the A.E.A.T. and Social Security.

- Do not provide services as an employee or self-employed person in another activity affected by the RED mechanism (except in the case of multiple activities).

- Do not receive another benefit for cessation of activity or sustainability.

- Not having reached the ordinary retirement age (except not proving contribution period.)

Particular Requirements

- Resolution authority for the application of the RED mechanism

- Affectation of 75% of registered people with an obligation to contribute, having to request their inclusion from the Labor Inspection for the purposes of issuing the pertinent report in order to receive the benefit (only for companies or self-employed workers with salaried workers)

- Reduction of 75% of ordinary income or sale in the fiscal semester prior to the application submitted to the Administration with respect to the same previous period.

- Monthly net income for the semester prior to requesting the benefit does not reach the SMI or contribution base (if this is lower).

- Comply with the labor obligations acquired by the RED mechanism (only for companies or self-employed workers with salaried workers).

- Economically Dependent Workers must prove:

- Not providing services in another company.

- The company to which it provides services has joined the RED Mechanism.

- Reduction in ordinary income or sales of 50% in the semester prior to the application compared to the same previous period.

- The monthly net return for all activities in the semester prior to the application is not higher than the SMI or your contribution base, if it is lower.

Deadline for the provision of the application

- With salaried workers: Within 15 days following receipt of the resolution from the Labor Authority, the economic effects taking effect from the date of application, provided that it is submitted on time, otherwise, on the first day of the month following the application.

- Without salaried workers: The economic effects will occur from the first day of the month following the request.

- Economically Dependent Workers: The economic effects will occur from the first day of the month following the request.

Protective action

- Economic benefit: 50% of the Regulatory Base (corresponds to the base of Section 3 of the reduced table).

- Payment of the amount of the contribution to the Social Security of 50% of the regulatory base of the benefit (The self-employed worker is the one obliged to pay the entire contribution ).

Duration

The benefit has a maximum duration of one year:

- With salaried workers: duration of three months, extendable by quarters.

- Without salaried workers: the one that appears in the application without exceeding 6 months, with the exception of three extensions of two months each.

Access to the benefit does not imply consumption of contributions in the future recognition of cessation of activity.

Child care or births and termination benefit

In the event that at the time of the causative event or during the receipt of the termination benefit, the worker is in a situation of birth, adoption, custody for the purposes of adoption or foster care, the benefit recognized for that reason will continue to be received and once it expires, he/she will begin to receive the termination benefit (as long as he/she meets the required requirements in the norm) or in the second case, until the exhaustion of the duration period to which one is entitled for the severance benefit.

Incompatibility

- Unemployment

- Simultaneity of benefits RED Mechanism

- Cessation of activity

- Active insertion income

- IT benefit, the duration of which will be deducted from the access time to the cessation of activity benefit.

- Any Social Security benefit incompatible with work.

- Other self-employed or employed work (except pluriactivity at the time of the causative event if the sum of the average monthly remuneration of the last four months immediately after the birth of the right, plus the severance benefit, is less than the average sum of the SMI at the time of the birth of the right)

In the event of If two rights derived from the RED Mechanism occur, the worker is given the right of option.

Suspension

- Due to the imposition of a minor or serious sanction included in the LISOS

- During the deprivation of liberty due to serving a sentence.

The resumption of the right will occur when the reason for suspension ends and at the request of the interested party, whose reactivation will arise from the moment of the end of the cause that generated the suspension, provided that it is requested within the following 15 days, otherwise, it will take effect on the first of the month following the request.

Termination

- Cause the right to a Social Security benefit

- Exhaustion of the term of the recognized benefit.

- Increase in the income of the company or self-employed above the established limits.

- Deregistration from the RETA

- Due to a sanction specified in the LISOS.

- Failure to comply with obligations with the RED Mechanisms (only for companies or self-employed workers with salaried workers).

- Loss of Social Security benefits due to the provisions of the forty-fourth additional provision (only for companies or self-employed workers with salaried workers).

Obligations

- Self-employed with employed workers

- Join the activity after the lifting of the RED mechanism measures.

- Keep workers' contributions up to date with payments.

- Maintain activity for at least six consecutive months.

- Self-employed without employees

- Join the activity once the benefit ends.

- Maintain activity for at least six consecutive months.

Competent jurisdiction and prior claim

The jurisdictional bodies of the social order will be competent to hear the decisions of the managing body, relating to the recognition, suspension, or termination of benefits due to cessation of activity, as well as their payment.

The interested party must make a prior claim before the gesture body before going to the competent social order jurisdictional body.

Common Requirements

- Registration in the Special Regime (according to the activity)

- Have covered the waiting period due to cessation of activity (twelve months within the twenty-four months immediately prior to the cessation situation).

- Payment Current with the A.E.A.T. and Social Security.

- Do not provide services as an employee or self-employed person in another activity affected by the RED mechanism (except in the case of pluriactivity).

- Do not receive another benefit for cessation of activity or sustainability.

- Not having reached the age of ordinary retirement (except not accrediting contribution period)

- Subscription of the activity commitment.

Particular Requirements

- With salaried workers:

- Resolution authority for the application of the RED mechanism in its sectoral modality.

- Affects 75% of registered people with an obligation to contribute, having to request their inclusion from the Labor Inspection for the purposes of issuing the pertinent report in order to receive the benefit.

- Monthly net income for the semester prior to requesting the benefit does not reach the SMI or contribution base (if this is lower).

- Comply with the labor obligations acquired by the RED mechanism and up to date with payment.

- Investment project and activity to be developed

- Without salaried workers:

- Reduction of 75% of ordinary income or sale in the fiscal semester prior to the request submitted to the Administration with respect to the same previous period.

- Monthly net income for the semester prior to requesting the benefit does not reach the SMI or contribution base (if this is lower).

- Investment project and activity to be developed

- Requalification plan

- Economically Dependent Workers must prove:

- Not provide services in another company.

- The company to which it provides services has taken advantage of the RED Mechanism.

- Accreditation of the applicant's inclusion in the requalification plan of the client company and sent to the labor authority.

- Reduction in ordinary income or sales of 50% in the semester prior to the application compared to the same previous period.

- Monthly net income for all activities in the semester prior to the application, not higher than the SMI or your contribution base, if it is lower.

Deadline for providing the request

- With salaried workers: Within 15 days following receipt of the resolution from the Labor Authority, the economic effects arising from the date of request, provided that it is submitted on time, otherwise, on the first day of the month following the request.

- Without salaried workers: The economic effects will occur from the first day of the month following the request.

- Economically Dependent Workers: Within 15 days following receipt of the resolution from the Labor Authority, the economic effects taking effect from the date of application.

Protective action and Duration

- Benefit in single payment modality:

- Applicant with workers: Amount of 70% of the Regulatory Base linked to the duration of the RED Mechanisms, marking as limits the protection period for cessation of activity based on the months contributed for cessation of activity during the 48 months prior to cessation.

- Application without workers: Amount of 70% of the Regulatory Base linked to the protection period of cessation of activity based on the months of contributions for cessation of activity during the 48 months prior to the cessation and provided that 18 months have not elapsed since the recognition of the last right to cessation, where in turn the months of contribution and used in previous termination benefits will not count for the purposes of the new benefit.

The amount received must be invested in a new activity such as work. Self-employed or allocate 100% of the amount to a commercial entity whose constitution is new or already established, but dates back to a date less than 12 months from the contribution of the new partner and in both cases, provided that it has effective control of the company.

- Payment of the amount of the contribution to the Social Security 50% of the Regulatory Base of the benefit (The self-employed worker obliged to pay the entire quote ).

The Regulatory Base will be made up of the contributions for the 12 continuous months immediately preceding the agreement of the Council of Ministers.

Child care or births and termination benefit

In the event that at the time of the causative event or during the receipt of the termination benefit, the worker /a is in a situation of birth, adoption, custody for the purposes of adoption or foster care, he/she will continue to receive the benefit recognized for that reason and once it expires, you will receive the cessation benefit (provided that you meet the requirements set out in the standard) or in the second case, until the expiration of the duration period to which you are entitled for the cessation benefit.

Incompatibility

- Unemployment

- Simultaneity of benefits RED Mechanism

- Cessation of activity

- Active insertion income

- IT benefit, the duration of this will be deducted from the access time to the cessation of activity benefit.

- Any Social Security benefit incompatible with work.

- Other self-employed or employed work (except pluriactivity at the time of the causative event if the sum of the average monthly remuneration of the last four months immediately after the birth of the right, plus the severance benefit, is less than the average sum of the SMI at the time of the birth of the right)

In the event of two rights derived from the RED Mechanism, the worker is given the right of option.

Competent jurisdiction and prior claim

The jurisdictional bodies of the social order will be competent to hear the decisions of the managing body, relating to the recognition, suspension, or termination of benefits due to cessation of activity, as well as their payment.

The interested party must make a prior claim before the gesture body before going to the competent social order jurisdictional body.