New aid for the group of self-employed workers

In order to maintain support for the group of self-employed workers, new aid has been established that complements the extraordinary benefit for Cessation of Activity that was created during the state of alarm, and which will be applicable from July 1.

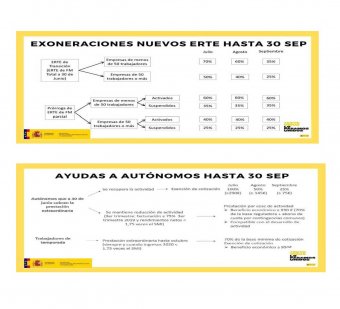

Among the new measures adopted in RDL 24/2020, of June 26, are the reduction of social contributions during the next three months for the self-employed who have received the benefit, the compatibility of the activity with access to the ordinary benefit for Cessation of Activity and a special benefit for seasonal workers.

- The beneficiaries who have received the extraordinary CATA.COVID-19 benefit until June 30, will not have to pay social contributions for the month of July and will have a 50% exemption in August and 25% in September (as long as they remain registered in the special regime during those months and do not request the benefit of the section next).

- Those self-employed workers whose activity continues to be affected by the effects of the declaration of the state of alarm, will be able to access a Cessation of Activity benefit equivalent to the ordinary one if their billing in the third quarter is 75% lower than that of the same period in 2019, and as long as their net income in said quarter does not exceed the amount of €5,818.75. It is important to note that to be entitled to the benefit with effect from July 1, you must submit your applications before July 15. If they are presented on the same day, July 15 or later, the effects of the benefit will be born the day after their presentation. After the third quarter of 2020, when its performance can be known, a verification of compliance with the requirements will be carried out, proceeding to review the corresponding benefits. If, during the receipt of the benefit, the self-employed person notices that he or she is not going to meet the economic requirements to maintain the recognized right, he or she may voluntarily renounce the benefit.

- An extraordinary Cessation of Activity benefit has also been created for the group of seasonal self-employed workers who could not benefit from the extraordinary benefit for the month of March and equivalent to this one. For the purposes of this benefit, a seasonal worker has been considered to be whose only work in the last two years, had been carried out in the Special Regime for Self-Employed Workers (RETA) or in the Special Regime for Sea Workers, during the months of March to October and remaining registered in the regime, for at least at least five months a year within each of those periods and as long as your income in 2020 does not exceed €23,275. As with the previous benefit, it should be noted that to be entitled to the benefit with the effects of June 1, you must submit your applications before July 15. If they were presented on the same day, July 15, or later, they would lose 45 days of benefit, since the effects of the benefit would be born the day after their presentation.

On the Fraternidad-Muprespa corporate portal you can find all the information necessary to request and process these benefits.