Request for Cessation of Activity of the Self-Employed Worker (CATA) due to COVID-19

At Fraternidad-Muprespa we are aware of the impact that the COVID-19 coronavirus crisis is having on all families and businesses, so we will provide all the facilities so that you can request the benefits that have arisen in response to unexpected needs.

Yesterday, Royal Decree-Law 8/2020, of March 17, on extraordinary urgent measures to address the economic and social impact of COVID-19, was published. In its article 17, a new “Extraordinary benefit for cessation of activity for those affected by declaration of the state of alarm for the management of the health crisis situation caused by COVID-19”.

APPLICATION SUBMISSION CHANNELS

Given that, in compliance with the provisions of the state of alarm protocol, our centers are closed or with the minimum necessary staff, two channels have been enabled so that you can manage this new service:

- Channel 1. Digital Office: if you are already a user of this channel or want to register, you can request this benefit online. Your request will be assigned to a personal manager and we will try to resolve it as quickly as possible.

- Channel 2. Mailbox: in the following list you can check, depending on your nearest center, the email address to which you can send your request and the attached documentation. Your request will be analyzed as soon as possible by our managers.

WHO CAN REQUEST THIS NEW BENEFIT?

- Self-employed workers who have had to close their business (open to the public), in compliance with the restrictions imposed by the state of alarm, and who could not continue providing services in the remote work modality.

- Examples included: cafes, restaurants, clothing stores, hardware stores, ...

- Examples not included: online stores, markets, agencies (unless they prove the impossibility of teleworking), pharmacies, opticians, ...

- Self-employed workers who, even though they can keep their business open, can prove a decrease in their income in the last month of more than 75% of what they had, on average, in the last semester.

WHAT DOCUMENTATION SHOULD YOU PROVIDE?

In all cases you must present:

- Cessation of activity benefit application form (the online form is available in our Digital Office and in .PDF format our website).

- Photocopy of DNI / NIE / Passport.

- Photocopy or photograph of the last three quote bulletins.

- TGSS certificate of being up to date with the payment of your fees.

- Form 145 IRPF - Communication of data to the payer.

- In the case of declaring dependent children, a photocopy or photograph of the family book.

Other documentation may be required throughout the processing of your case.

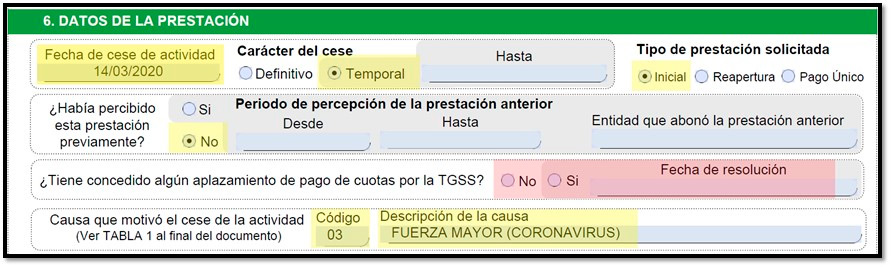

In the first of the cases (closing of the business open to the public), you must submit the application for benefit for cessation of activity, informing section 6 as follows:

Filling in the fields in red as appropriate.

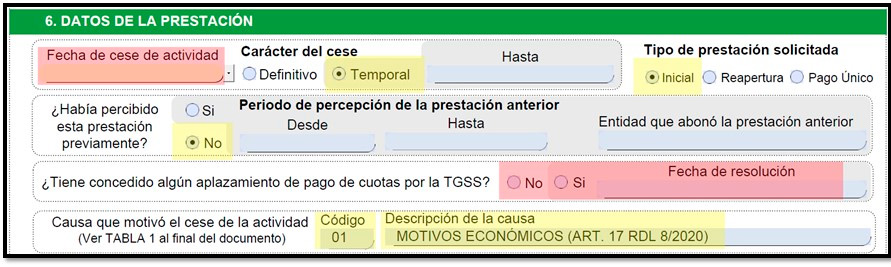

In the second of the cases (income losses greater than 75% in the last month compared to the average of the last semester) you must submit the application for benefit for cessation of activity, informing section 6 as follows:

Where the date of cessation of the activity will be the last day of the month in which the 75% decrease in income is being accredited with respect to the last semester and completing the data in red as appropriate.

In addition, in this second case, the following must be submitted additionally:

- Model 130 - from the four quarters of 2019.

- Model 131 - from the last quarter of 2019.

- Profit and loss account broken down month by month for the entire year 2019.

- Breakdown profit and loss account for January, February and March 2020.