RDL 18/2021: Sixth additional provision

. implementation of this provision, it is interpreted that we are faced with a mechanism of access to the benefit of ordinary cessation of activity regulated in title V of the TRLGSS due to force majeure, with the only exception that the waiting period will not be required. The rest of the requirements will be required.

The text highlighted in red is susceptible to new interpretations and changes.

Who is this benefit aimed at?

To those self-employed workers who carry out their activity on the island of La Palma and are forced to suspend or cease their activity as a direct consequence of the volcanic eruption registered in the Cumbre Vieja area.

Prerequisite access requirements

- Be registered in the Special Regime for Self-Employed and contributing to the contingency of cessation of activity at the time of the volcanic eruption (September 19, 2021).

- Having requested withdrawal from the corresponding special regime due to the temporary or definitive cessation of the activity.

- Not having the ordinary age and the necessary disability to access the retirement benefit.

- Be up to date with the payment of contributions to the Special Regime (otherwise, from the Mutual Fund we will invite you to get up to date, within a non-extendable period of 30 days).

- If you have workers under your charge, it will be a requirement that you have complied with the guarantees, obligations and procedures regulated in labor legislation with respect to your employees.

- Not enjoying any pension or Social Security benefits, unless these have been compatible with the work that gave rise to CATA protection.

- Not being engaged in activity as an employee or self-employed person, although its performance does not imply mandatory inclusion in the self-employed regime.

- In the case of an establishment open to the public, its closure will be required during the receipt of the subsidy or its transmission to third parties.

In addition to those who meet these requirements, self-employed workers who do not meet the above requirements (even those who did not have cessation of activity coverage) but who as of September 30, 2021 have received any of the benefits included in arts. 6, 7 and 8 or in the second transitional provision of Royal Decree-Law 11/2021, of May 27 and who are forced to suspend or cease their activity as a consequence of the volcanic eruption registered in the Cumbre Vieja area on La Palma.

Access by this means will also require unsubscribing from the RETA.

Conditional access requirement

None.

What does the benefit consist of?

This benefit consists of 2 financial aids:

- The payment of a economic benefit . The amount of the benefit will be calculated as 70% of the average contribution bases for the last 12 months , with the application of the maximum and minimum limits calculated on the IPREM based on the number of dependent children.

Note: If you have less than 12 months of contributions until the cessation of activity, the regulatory base of the benefit will be calculated as the average of the existing contributions immediately prior to and continued to the month of October.

- The entry into the TGSS of the contribution of the fee for common contingencies .

Is there an obligation to continue contributing to Social Security?

No. Temporary suspension or definitive cessation of activity must lead to withdrawal from the corresponding Special Regime. In any case, during the receipt of this benefit the mutual insurance company will continue to contribute to the TGSS for you the fee corresponding to common contingencies.

How long will the benefit last?

It will be necessary to distinguish 2 situations:

- Workers WITHOUT sufficient DEficiency to access the ordinary benefit:

The benefit will have a maximum duration of 5 months, provided there is no prior cause for termination, and the application is submitted within the deadline.

- Workers WITH sufficient deficiency to access the ordinary benefit:

The benefit will have the corresponding duration based on the contributions they have not consumed due to cessation of activity, according to the provisions of art. 338 TRLGSS and 5 additional months will be added (in application of the provisions of this DA 6 of Royal Decree-Law 8/2021).

The perception time of the 5 months established by the sixth additional provision of Royal Decree-Law 8/2021, will not reduce or consume benefit periods due to cessation of activity .

What are the incompatibilities with this benefit or the causes of termination?

They will be those provided for in arts. 340 and 341 of the TRLGSS and which can be summarized in the following assumptions.

It will be a cause of incompatibility :

- Any Social Security benefit that has been received, unless it is compatible with self-employment activity.

- The performance of any work as an employee (regardless of the income that may arise).

- Receive aid for fleet paralysis (for Sea workers).

They will cause the termination of the benefit:

- Reach the maximum duration planned for the benefit.

- By reaching the ordinary retirement age or, in the case of self-employed workers included in the Special Regime for Sea Workers, theoretical retirement age, except when the requirements to access the pension are not met. contributory retirement

- The death of the beneficiary.

What is the deadline to request this benefit?

In the absence of a deadline having been specified in the regulation, it will be understood that the deadline for requesting the benefit and its effects will be those established in the provision for ordinary cessation of activity, regulated in title V of the TRLGSS.

That is, they may request the benefit from the day they withdraw from the RETA until the last day of the following month, and they will accrue the benefit from the first day of the month following their withdrawal from the RETA. If it is submitted after the previous deadline, the benefit would be issued from the day following the request and the previous days would be lost.

How can I process my request for access to this benefit?

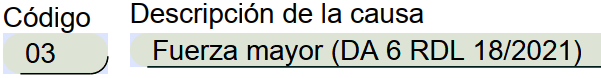

The request for this benefit must be made through the form for ordinary cessation of activity benefit, informing the following as the reason for cessation:

Said request must be accompanied by its corresponding sworn declaration (without the need for any of the annexes).

You can send your request electronically to the email address of your Fraternidad-Muprespa delegation closest to you HERE .

Can the benefit be waived or withdrawn after having requested it?

Yes, the worker who has requested payment of this benefit may renounce the benefit at any time prior to its exhaustion.